So, you’ve worked hard to get your foot on the property ladder and own either a home or an investment property – which has likely performed well over the past couple of years, along with an increase in your income. How then, can you use your current position to grow an investment property portfolio?

As with all aspects of property and finance, equity and cashflow are still the key factors to building an investment property portfolio. However, with the assistance of a knowledgeable mortgage broker you could unlock the available equity in your first property to bank roll the deposits for property number two, three, four or more!

So how does it work? Let’s break it down into steps and visuals.

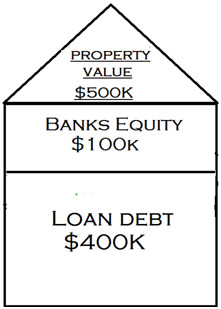

Step 1: Let’s say that five years ago you took out a $400,000 home loan to purchase a $500,000 property. This represents a loan to value ratio of 80% and at this stage, there is no opportunity to use equity to purchase further investment properties.

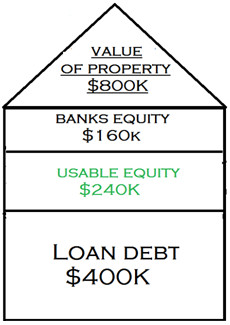

Step 2: Fast forward to today and thanks to a well performing property market your first property has increased in value to $800,000, however your loan has remained the same at $400,000. Your original loan now represents a loan to value ratio of 50% and as such you now have $240,000 of useable equity available to you.

At this stage, we can arrange a refinance and equity release to pull $240,000 cash out of your property to be used as a deposit for the next property or two.

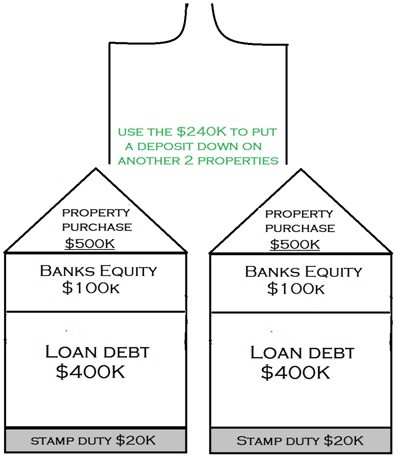

Step 3: The $240,000 available from the equity release can now be used as a deposit and to cover stamp duty for two $500,000 investment properties!

You now own an $800,000 property, plus another two $500,000 properties!

The beauty of this strategy is your ability to repeat it multiple times throughout the course of your investing lifetime. Over time, you would expect the value of these properties to perform well, producing even more useable equity, and an increasing rental income to assist with monthly cashflow.

Think about it – property number one has paid for property number two and three. Fast forward ten years and we could expect property number one to pay for property number four and five, property number two to pay for property number six and seven, and property number three to pay for property number eight and nine. Very powerful indeed!

If you would like to sit down for a strategy session to discuss how you can build your own property portfolio,please contact me and I will be happy to arrange.

Best of luck!

Sam Panetta