Financial freedom is a term that is often thrown around but for many of us we have never stopped to think about what it really means. In light of the current noise in the financial services industry I figured it was a good time to try and find the light through the clouds!

The concept of financial freedom is a term that drives most of us but in my experience, there is a fundamental difference between those who continue to dream about it and those who are actually able to turn that dream into reality. So what does financial freedom mean and how do we get there?

Firstly, financial freedom can be subjective and therefore there is no real clear way to define it as a ‘catch all’ for everyone. The way I like to explain financial freedom is as follows:

Financial Freedom is the point in which you have complete control

to live life on the terms you choose.

Sounds great right? Still a bit vague…

The first issue is that everyone has a different idea of what financial freedom actually means to them and as such, they lack the clarity around what they are actually working towards. Listening to a talk recently by Glen Gerreyn, he said,

“People don’t have a motivation problem, they have a vision problem.”

I couldn’t have said it any better myself as it is so true. As busy professionals and business owners in 2018, we are so distracted by EVERYTHING that we never take the time to think about what we really want, what we are REALLY working towards and what our idea of financial freedom REALLY is. Unless we are taking the time to define it, how are we supposed to keep ourselves on track?

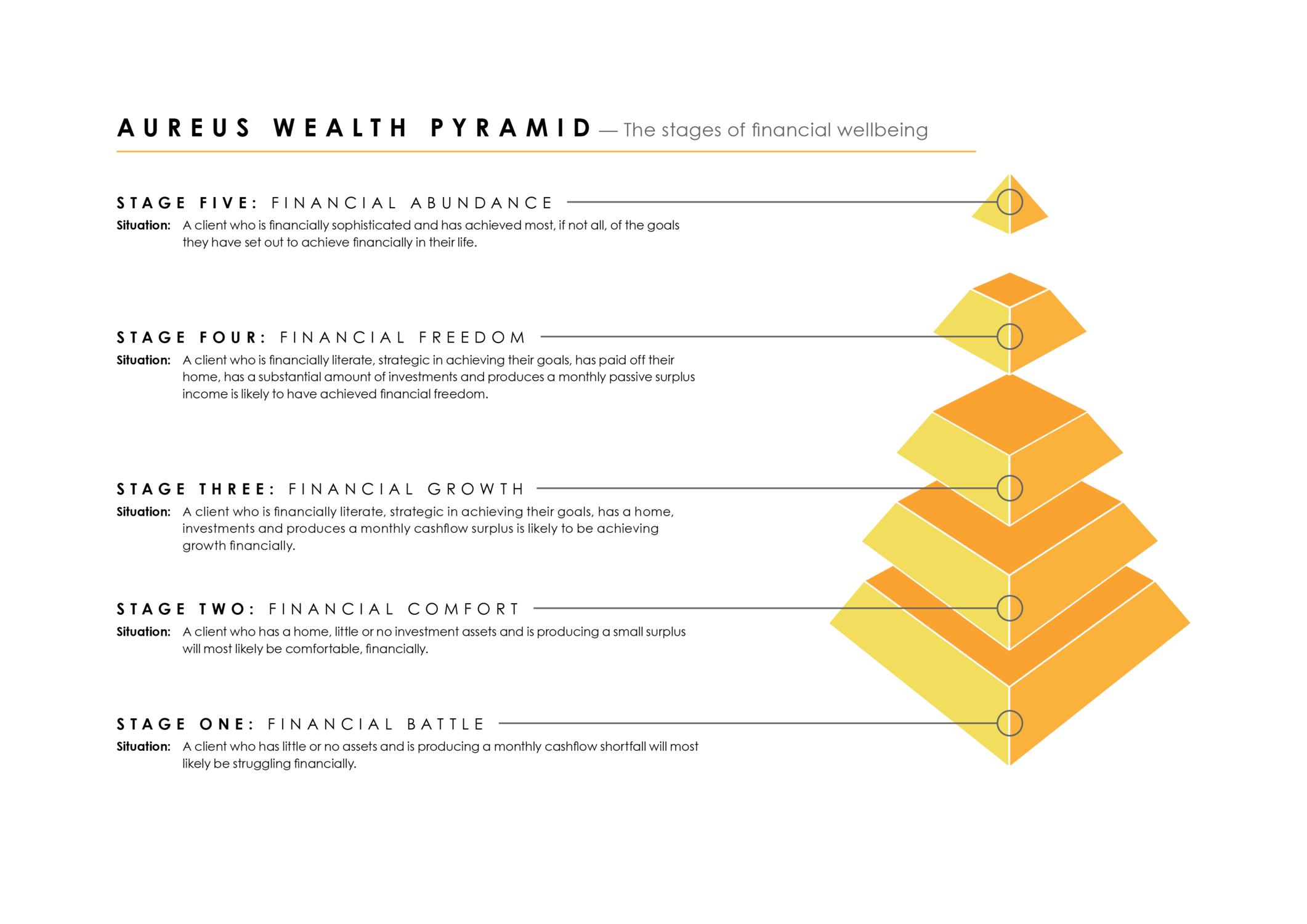

With this in mind, my business partner Sam and I created a process to make it easy for people to break this down into measurable and objective stages. We call this The Wealth Pyramid.

The idea behind this is simple:

- We need to know where we are right now, even if that is difficult to come to terms with,

- We need to know where we want to go and make it specific,

- We need to know what path to take to get us there with peace of mind and certainty.

In order to achieve this, we need to break down what we need to achieve at each stage of the pyramid to help us work out what we need to do to make it happen. I will cover this more in another blog post but for now let’s focus on stage 4 which is financial freedom.

From our perspective, financial freedom is achieved when you are able to answer the two questions below:

- Have you paid off your forever home in full?

- Do you have enough passive income or realizable investments that allow you to choose how you spend your time?

Let’s explain this further. Your forever home is the place that you can see yourself living in for the foreseeable future. This is typically the most expensive house you intend to own which you have the ability to have paid off in full. In my experience, I see that many people aspire to continue to upgrade their home but in many cases they are just renting their house from the bank. You need to work out your plan to get your home paid off and if you have scraped into buying a $5m waterfront, the likelihood of you doing this is pretty slim.

The reason we want this paid off is that it will have a drastic impact to your cashflow requirements, give you a solid financial base for you to continue to build your empire and allow significantly more surplus for you to fund your lifestyle or reduce how much you need to live.

Secondly, you need to define how much passive income you actually need and this typically happens in 3 stages:

- Enough to cover your fixed costs such as bills, utilities, groceries and other necessities of life.

- Enough to cover your lifestyle and personal spending such as eating out, travel and treating yourself .

- Enough to amplify your lifestyle, surplus to give back to causes you believe in and make a difference in the world. We refer to this as financial abundance stage.

So firstly you need to work out what you need to craft the life you desire. Financial freedom might mean having enough passive income to work part time, be able to pursue a start up business or it could mean stopping work completely. I advocate the best way to work this out is to do a personal profit and loss or better known as a budget. By putting all of the expenses associated with the various stages of your life into a spreadsheet, this will help you model each scenario and work out what you need and therefore how much you need to provide that lifestyle for you and your family.

This process along with most future planning is all about reverse engineering scenarios and working out what it will require you to do today, next month, and next year to keep you on track. Once we have this road map we then need to ask ourselves whether we are willing and ready to stick the course in pursuit of the final destination.

The hardest part of this entire process is working out what you really want and be willing to accept that your goals and the path you take will likely change as you progress through life. Financial freedom is ultimately about having flexibility to choose how to spend your time and as such, the more means we have available, the more flexibility we have to pursue what we want.

If you have questions around your path in pursuit of financial freedom or want to get some help crunching the numbers around how you can create your ideal road map, please feel free to reach out to us.

Thanks for reading,

Jackson | The Wealth Mentor