ATO Issues

ATO issues can be intricate, but with Aureus, they are navigated with expertise and strategic insight. Whether it’s audits, disputes, or clarifications, we stand as your ally, ensuring that every interaction with the ATO is handled professionally, offering resolution and clarity.

Our approach transforms potential challenges into alignment, compliance, and strategic insight opportunities.

CGT, GST, and FBT

Capital Gains Tax (CGT), Goods and Services Tax (GST), and Fringe Benefits Tax (FBT) are pivotal aspects of the tax landscape for small businesses in Sydney and are often misunderstood or overlooked.

Aureus Financial offers specialised services in managing these specific tax obligations. We ensure that your business meets every statutory requirement in a way that is conducive to your overall financial and operational objectives.

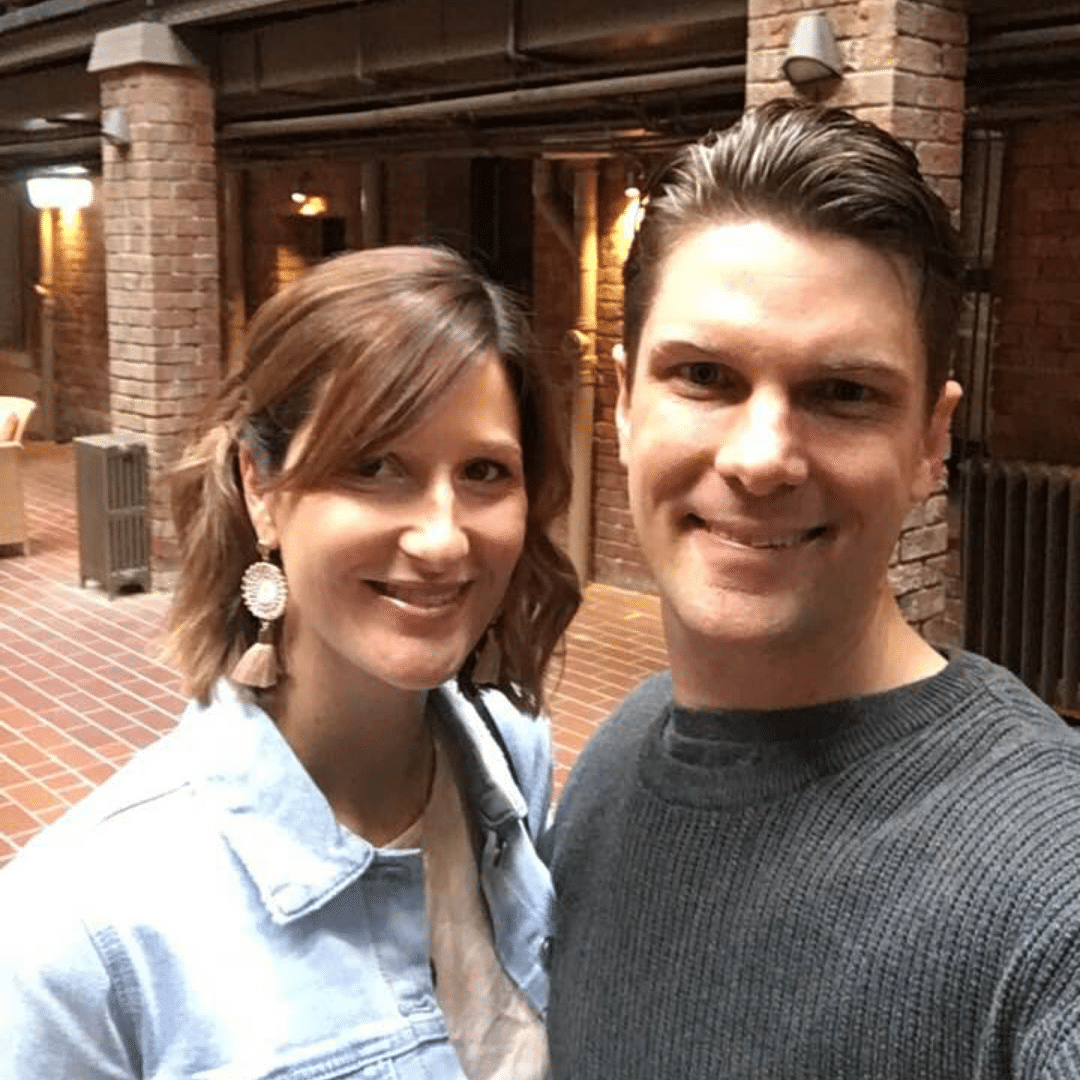

Join the Aureus Financial Family

Choosing Aureus Financial for your small business tax needs isn’t just about professional service; it’s an invitation to join a Sydney family that values your business’s growth and financial prosperity.

Each of our clients is welcomed into a partnership deeply rooted in mutual growth, shared insights, and tailored solutions. With Aureus, you find more than a service; you discover a home where your small business’s financial well-being is nurtured to flourish.