Can I Finance Plant and Equipment?

Absolutely! Equipment financing is specifically designed for businesses that need to purchase or lease machinery, vehicles, or other essential equipment. Instead of paying the full upfront cost, equipment financing allows you to spread out payments over time.

This way, you can maintain healthy cash flow while obtaining the tools for your business operations. Aureus Financial can guide you to lenders specialising in this type of financing, ensuring you get the best terms.

Which Business Loan is Right for Me?

The best business loan for your business depends on various factors, like your business’s financial health, the amount you need, the purpose of the loan, and the repayment period you’re comfortable with.

Startups might lean towards angel investors or venture capital, while established businesses could benefit more from term loans or lines of credit. With the myriad of options available, it’s essential to consult with a mortgage broker familiar with the intricacies of the business lending landscape in Sydney.

At Aureus Financial, we’ll work closely with you, delving into your business specifics and guiding you towards a loan solution that aligns with your goals and objectives.

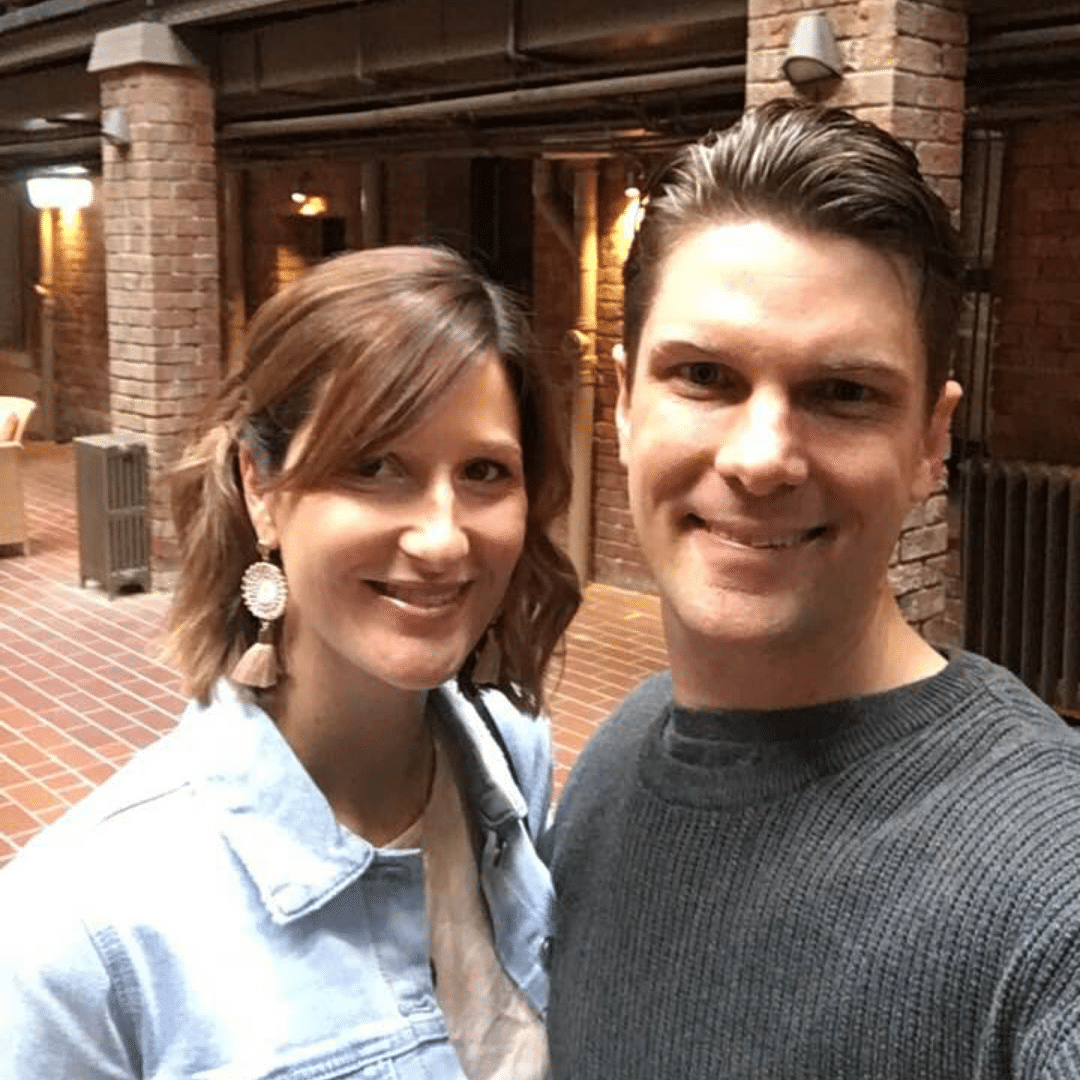

Join the Aureus Financial Business Family

Properly seizing the right business opportunity can be the difference between stagnation and growth. The world of business loans is complex, and navigating it can be daunting.

This is where being part of the Aureus Financial family becomes invaluable. We don’t just offer services; we offer partnerships. We believe in your business dream as much as you do.