Refinancing Existing Loans on a Pension

Being on a pension shouldn’t exclude you from seeking better loan terms. We can guide you if you’re an existing homeowner and wish to refinance for a more favourable rate or different loan features.

Aureus Financial has successfully helped numerous pensioners refinance their loans, ensuring their financial arrangements align with their current needs.

Reverse Mortgage Loans

A reverse mortgage can be an attractive option for pensioners looking to leverage the equity in their home. It allows homeowners to borrow money using the equity in their home as security, providing additional funds for living expenses, medical bills, or other needs.

However, navigating this option with complete understanding and caution is crucial. At Aureus Financial, we offer expert guidance on reverse mortgages, ensuring pensioners make informed and beneficial decisions.

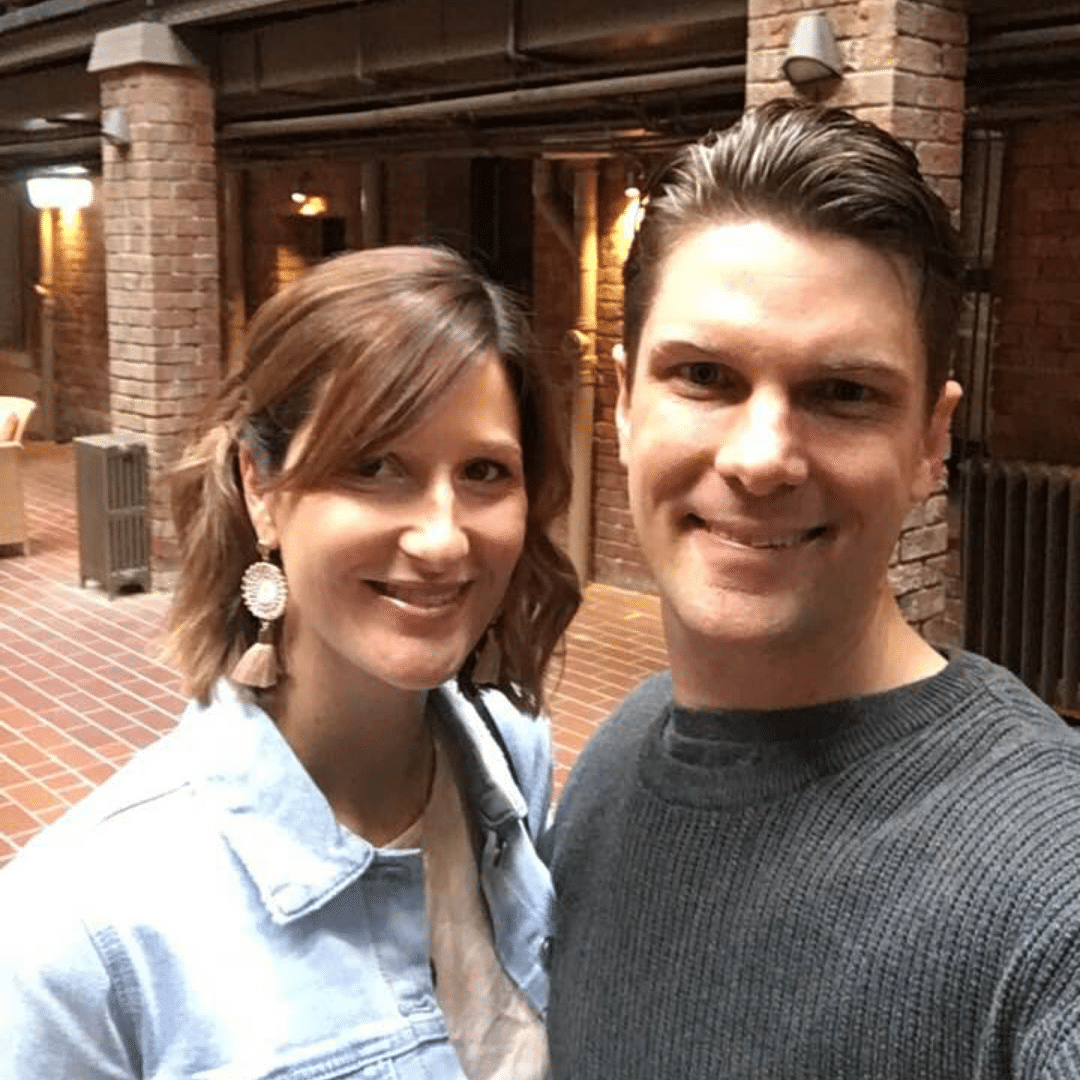

Join the Aureus Financial Family

The first step towards financial empowerment is choosing the right partner on your journey. At Aureus Financial, we pride ourselves on being a service provider and an extended family to all our clients.

From the moment you start a conversation with us, you’ll feel the difference — personalised attention, transparency, and a genuine desire to see you succeed. We stand by you, celebrate your milestones, and are here during challenging times.

So, why wait? Today, Be part of the Aureus Financial family and experience a relationship built on trust and mutual respect.