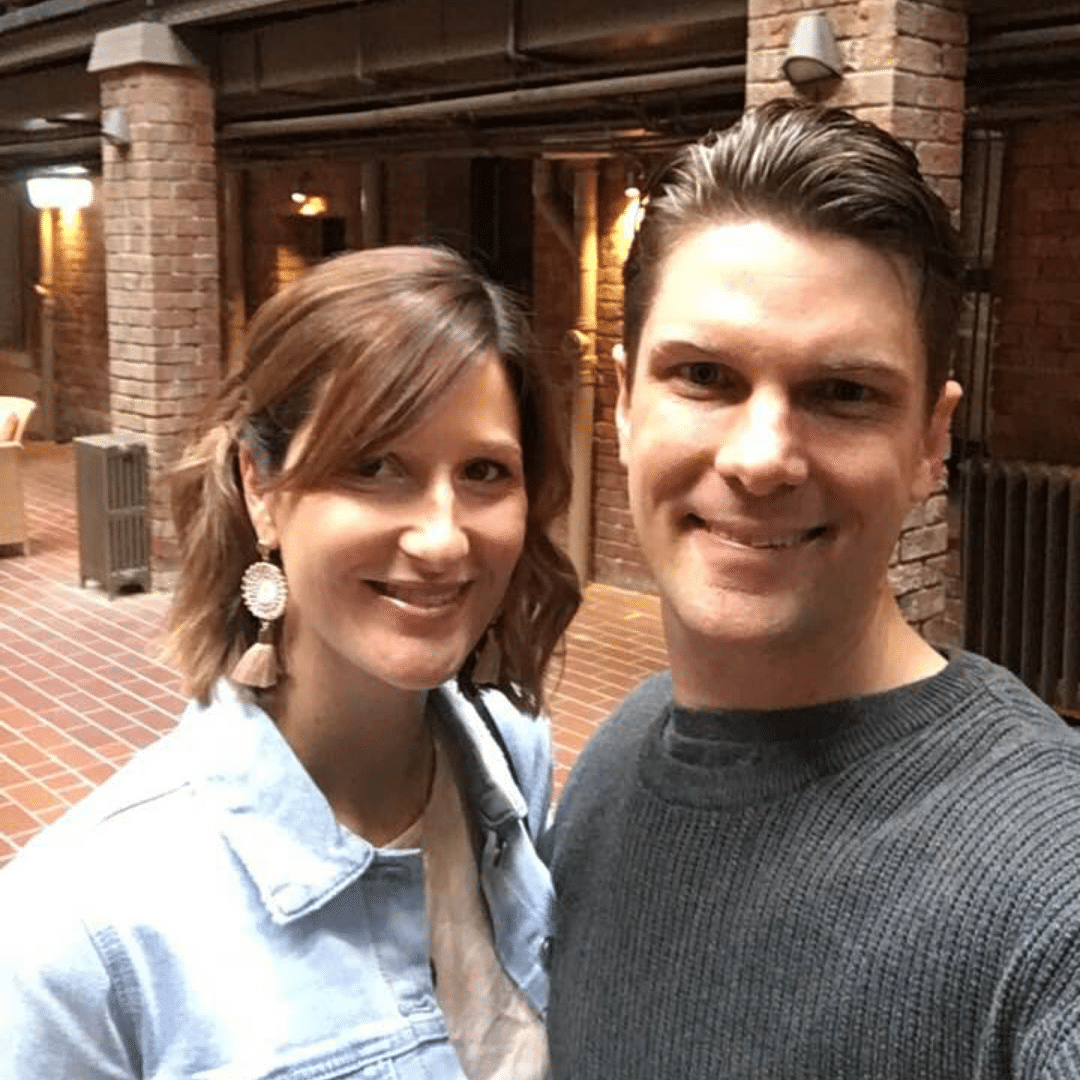

Navigating financial waters is a significant part of any relationship’s journey. Aureus Financial stands out as the top choice for couples in Sydney who desire expert guidance tailored to their combined financial aspirations and challenges. We prioritise both partners, ensuring their mutual financial goals and individual perspectives are given due consideration in our strategies.

Why Couples Choose Aureus Financial as Their Financial Advisors

Couples, whether newly engaged or celebrating their silver anniversary, trust Aureus Financial for several reasons. We understand that every relationship is unique, and so are its financial dynamics.

Our approach is not one-size-fits-all; we customise our advisory to resonate with each couple’s aspirations, concerns, and dreams. This, combined with our industry-leading expertise, makes us the first choice for couples seeking a harmonious financial future.

Book Your No Obligation Chat

At Aureus Financial, we believe that trust is foundational. This is why we invite couples for an initial no-obligation chat.

It’s a chance for us to understand your financial aspirations and concerns and for you to get a feel for how we can be instrumental in shaping your financial future together.

Financial Advisory Success Stories

Our Financial Advisors Helped Thousands Of People Like You Build The Financial Future They Want

With our battle-tested strategies and expert coaching, you, too, can reach your financial goals and live the life you’ve always wanted.

“Jackson has a way of simplifying money to help you get clear on the action required to achieve the goal… A complete game changer for me and my family”

-Scott Gellatly

Scale My Empire

“I was new to business and didn’t know much about money and finance. Because of Jackson, I now have a successful and profitable business, have paid out our bad debts and we are now building wealth”

– Marius duPreez

Swell Marketing

“I was close to giving up and with Jackson’s help I have turned my business around and I am on track to have the best year ever! I even have my wife on board believing in me and my business.”

– Ivo Exposto

I & S Joinery

Book Your No Obligation Chat

If you’re looking for a financial advisor in Sydney, look no further than Aureus Financial. Contact us today to schedule a consultation with one of our experienced financial advisors. Let us help you secure your financial future.

Financial Planning Advisory For Couples: Common Questions

Finances can be a source of stress for many couples. Engaging with a financial advisor ensures both partners are on the same page, financial goals are aligned, and potential pitfalls are addressed. It’s about building a future together with confidence.

Aureus Financial offers couples a myriad of services, from individual and combined investment guidance to strategies for managing shared expenses, planning significant milestones like weddings or home purchases, and ensuring tax efficiency in their joint financial decisions.

An Aureus financial advisor provides couples with a clear roadmap to achieve their combined financial goals. From understanding and reconciling differing financial habits to crafting joint investment strategies and planning for future milestones, we provide a holistic approach that respects and incorporates both partners’ perspectives.

What sets Aureus Financial apart is our deep understanding of the nuances of couples’ financial dynamics. We don’t just focus on numbers; we consider emotions, aspirations, and the intricacies of relationship dynamics, making our advisory both comprehensive and empathetic.

Starting with Aureus Financial is seamless. Just schedule a no-obligation chat with us. We’ll walk you through our approach, understand your needs, and showcase how we can transform your combined financial journey.

Comprehensive Financial Advice for Couples:

Navigating the financial landscape as a couple requires more than just merging two bank accounts. It’s about combining two financial histories, habits, goals, and aspirations into a unified strategy that supports both partners.

Whether you’re newlyweds, have been together for decades, or are navigating the complexities of a modern relationship, a myriad of considerations can make financial planning as a couple distinct.

At Aureus Financial, we understand these intricacies and provide specialised advice tailored for couples. We’re here to guide you both on this financial journey, ensuring that you grow your wealth and strengthen your bond by making informed and cohesive financial decisions.

Strategies for Combining Incomes

Combining incomes, especially when both partners have different financial habits and obligations, can be challenging. At Aureus Financial, we walk couples through a systematic process to make this integration smooth.

We start by understanding each partner’s financial commitments, spending habits, and aspirations. Using this as a baseline, we recommend efficient strategies such as joint bank accounts for shared expenses, personal ones for individual needs, or a blend of both, ensuring transparency, mutual respect, and financial efficiency.

Living on One Income

The decision to live on a single income can arise from various reasons — a partner returning to education, childcare, health issues, or even a sabbatical. Regardless of the reason, Aureus Financial is equipped to guide couples on budgeting and reallocating resources without compromising on their lifestyle or long-term financial goals.

We focus on cost-saving strategies, emergency fund creation, and optimising the earning partner’s investments and tax breaks to ensure a comfortable living.

Investment Opportunities for Couples

When two incomes or sets of savings are at play, the investment canvas broadens significantly. Aureus Financial offers couples expert advice on diversified investment portfolios tailored to their combined financial goals and risk appetites.

Whether it’s investing in real estate, stocks, mutual funds, or other avenues, we ensure the couple’s investments are synergised for maximum returns and minimal risks.

Tax Implications for Couples

Merging finances or even just being in a relationship has its tax intricacies. Aureus Financial ensures couples understand these implications, guiding them on how to file taxes, the benefits of joint versus separate submissions, and strategies to avail of potential tax breaks.

We strive to ensure that couples don’t view taxes as a burden but as another aspect, they can efficiently manage together.

Financial Advice for Modern Day Couples

In 2023 couples come in all shapes and sizes and face unique financial challenges and opportunities. At Aureus Financial, we’re committed to offering tailored advice that respects and addresses these nuances.

From understanding potential tax implications to planning for family expansion or property acquisitions, our guidance ensures modern day couples have a clear financial path that respects their individual and combined aspirations.

Dividing Assets When Couples Split:

Separation or divorce can be emotionally taxing and becomes even more complicated when assets are involved. Aureus Financial provides couples with an impartial, transparent, and systematic approach to dividing assets.

We consider everything, from joint investments, property, to even retirement funds, ensuring that the division is fair, legally compliant, and minimises potential tax implications.

Join the Aureus Financial Family

Embarking on a financial journey as a couple is both exciting and demanding. It’s not just about the numbers but about your combined dreams, aspirations, and the future you envision together. By choosing Aureus Financial, you’re not just gaining expert financial advisors; you’re joining a family that genuinely cares about your collective growth.

Our team at Aureus takes pride in fostering long-lasting relationships with our clients. We’re dedicated to understanding your unique story, adapting to your evolving needs, and providing you with a seamless, personal experience.

Our Commitment to Education

Knowledge is the cornerstone of sound financial decision-making. At Aureus Financial, we believe that an informed client is an empowered one. Our commitment to education goes beyond just providing tailored financial advice.

We’re dedicated to equipping couples with the tools, resources, and knowledge they need to understand the financial landscape. Our aim is to ensure that you’re always in the know.

With Aureus by your side, you’ll make smarter financial decisions and gain the confidence that comes with understanding the ‘why’ behind each strategy we recommend.