Most Aussies are still living paycheck to paycheck, earning an insufficient amount for them to live a comfortable life. If you come across this article looking for a way to start breaking the cycle and live comfortably within your means, you’re on the right page. But before we hop on the financial freedom train towards living the life you truly desire, let’s differentiate financial freedom and financial independence.

Financial Freedom vs Financial Independence

Financial freedom and Financial independence are oftentimes mixed up. Most of us think they’re the same. But the reality is, they are very different from each other. To make it easier to understand let’s take the child who’s learning to walk, and apply that to your finances. Are you at a point in your life where you can financially stand on your own two feet? Can you go anywhere you want? Or are your barely making ends meet?

If you lost or quit your job today, do you still have enough income coming in through other sources to fund your current lifestyle and enjoy all the little extras beyond the bare basics? If your answer is yes. Congratulations, you are considered financially independent! You are one step closer to financial independence. If your answer is no, don’t get discouraged. Everyone can turn their financial life around with commitment and the right team by your side.

On the other hand, true financial freedom means that your passive income can cover not just your current lifestyle but support the lifestyle you’ve always dreamed of. Travelling across the globe without the financial strain, retiring early, buying that ocean-view property. Whatever your lifestyle goals are, achieving them without compromise defines financial freedom.

Now we’ve cleared that potential misunderstanding, let’s move on to the main reason why you are here; answering the question, “how to achieve financial freedom?” We have come up with 10 actionable steps to help you get started on your journey towards financial freedom.

1. Define what financial freedom means to you.

“I want to achieve financial freedom.” But what is financial freedom to you?

To achieve a goal, you need to define what it is for you. Whether it is a business goal, an educational goal, or in this case, a financial freedom goal. The concept of FIRE – financial independence, retire early – is a concept that many define their own financial freedom. It refers to the ability to retire early in your traditional job at an early age.

What’s yours?

Paying off your home in full can be your personal definition of financial freedom. It could also mean creating adequate passive income so you’ll have the choice whether you want to work or now. There are plenty of other definitions of financial freedom out there and you can make your own. Your financial freedom can mean paying off debts or having extra money to invest in your hobbies or anything. It’s all up to you to decide.

2. Invest in Financial education.

Investing in Financial education is an important step towards your journey to financial freedom. Reading this article is the start of being financially literate. The more you learn about financials, the easier it is to make wise financial decisions. There is a lot of content on the internet that can provide you with information, including this website. It has podcasts, free financial eBooks, and Financial advisors ready to help you with your pursuit of financial freedom.

3. Appoint a family finance officer.

You can skip this step if you’re single.

Households need an appointed family finance officer. This family member doesn’t make the family’s financial decisions but rather the one monitoring the progress the family has in achieving financial freedom and circulate the progress reports to the rest of the family. After you’ve appointed the family finance officer, set a weekly financial date with your partner. Not only can it help the family’s financial health it can also be great quality bonding time with your partner. During these weekly updates, you can discuss your progress towards financial freedom, plan a strategy to overcome challenges, and celebrate your wins over coffee or a good romantic dinner.

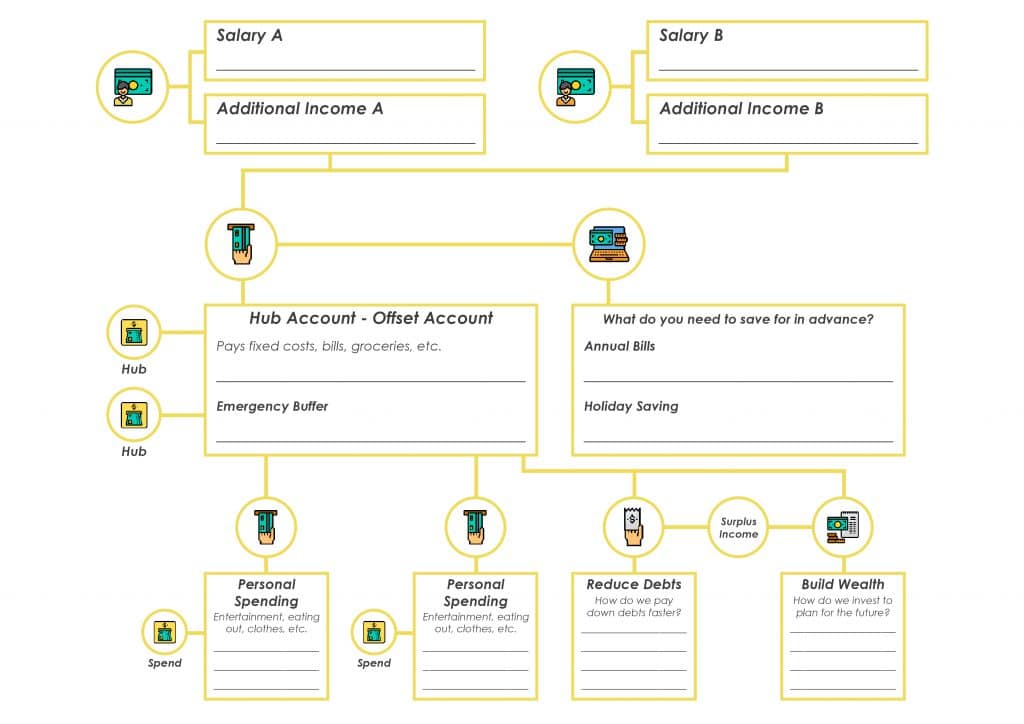

4. Open separate accounts.

Ensure that you build an adequate fund and find the right account for your financial goals by separating them into different bank accounts. For your consumable income, the money you use for your daily transactions such as shopping, food allowance, and transportation allowance you can put them into a transaction account. While cash for your savings can be put into a saving/deposit account. This account earns interest if you reach the minimum balance required to earn interest. The perfect account for retirement funds is a term deposit account. It requires your money to be left in the account for a certain amount of time. Interest is paid during the account’s maturity date.

Meanwhile, you should consider separating your emergency funds from your other savings to avoid spending it on non-emergency transactions.

Here’s a cash flow structure to guide you.

To better understand cash flow, you can check this “How to consolidate expensive debts and improve cash flow” blog.

5. Schedule a deposit date.

Financial freedom needs consistency. To ensure all your accounts are fully funded, make a system. Schedule a deposit date. Either you’ll write it on your calendar, planner, and post its reminder or type it on your phone calendar and turn on the reminder options, it’s all up to you. What matters is you set a date and you follow through. Consistency is key to financial freedom.

6. Save first and spend what is left.

“Work expands so as to fill the time available for its completion.”

-Parkinson’s law

Parkinson’s law for time management, in a nutshell, means that if you give yourself a week to complete a simple task, it will be harder to finish and you’ll end up taking a week to complete it. Some of you may know Parkinson’s law applies for time management but I’m here to tell you that it applies to everything, including your finances.

How?

Every month you always promise to yourself that you’re going to save a percentage of your paycheck. However, you see yourself spending on things you didn’t plan– a sale, retail therapy, and so on, and get up spending what’s left on your bills by the end of the month.

“Do not save what is left after spending, but spend what is left after saving.”

-Warren Buffet

Or simply the principle of “save first and spend what is left.”

You must be tired of paying your last bill only to find out that you have a few amounts left. If you’re wondering what you can do to break this cycle of earning and losing, we have the right tactic for you. It’s called the “save first and spend what is left.” principle, the exact opposite of what you’ve been doing. Calculate your income and expenses you have and the amount you should be able to save. If you do it right, it will have a huge impact on your overall financial health

7. Live below your income.

After understanding how you spend your money, it’s time to keep your spending as low as possible. This doesn’t necessarily mean you need to stop spending on your favourite morning coffee or your gym membership that you use to be stress-free and healthy. You don’t have to stop spending on the things that keep you happy and stress-free. Reducing cost can be bringing lunch to work, making your own coffee, or getting a less expensive car. Cut your spending without compromising your needs, be creative!

8. Plan how to pay off your debt.

A lot of people define financial freedom as being free from their debt. Although owning a house can be hard without a mortgage, we can start with something more achievable such as eliminating credit card debt and even car loans. Your little steps on financial freedom still have an impact on your overall health finances. Some finance experts suggest paying off your debt with the smallest balance first so we can build momentum and motivation.

It is important to keep in mind that when you do pay off that debt, don’t put the money you had been paying your debt with into your budget. Instead, take the amount and apply it to the next debt you’re trying to pay off.

Find out the little-known finance secrets from award-winning financiers that can help you pay off your debt and build wealth: Work With Aureus Financial Financiers

9. Build an emergency fund.

Financial freedom can be impossible to achieve if you give in to the temptation of using your emergency fund to pay off your debt faster. Don’t do it, this approach will backfire. Without an emergency fund, you risk increasing your high-interest debt. Instead, know your priority. Either if it’s paying off your debt or funding your savings, properly divide your available cash to each priority every month or every paycheck.

10. Prepare to leave your legacy.

This last step doesn’t have much anything to do with your pursuit of financial freedom, it’s all about who are the heirs of the money you will be leaving behind. Create a will and testament to make sure that your money that was earned by a lifetime of managing money correctly ends up to the rightful hands, your heirs.

Ensure that wealth you’ve worked hard to build gets on the right hands: Estate Planning and Commercial

REVIEW:

Follow these steps to create good money habits and have a peace of mind about your financial status:

- Define what financial freedom means to you.

- Invest in financial education.

- Appoint a family finance officer.

- Open separate accounts.

- Schedule a deposit date.

- Save first and spend what is left.

- Live below your income.

- Plan how to pay off your debt.

- Build an emergency fund.

- Prepare to leave your legacy.

The journey to financial freedom requires constant learning of the language of money. Don’t stop with this article, read more to learn more!