The right financial advisor can help you retire sooner, buy your dream house sooner, get better returns on your investment and do a barrage of paperwork that confuses the hell out of you. But how much do they cost? How do they get paid? How do you find good financial advisors? Are there any laws that govern their behaviour? If so, what are they? And most importantly, how can you find the best financial advisors?

In this article, we’ll cover all these and help you understand the world of financial advisors, so you can choose the best one that suits your needs. Let’s get started!

How Much Does A Financial Advisor Cost In Sydney?

The cost of hiring a financial advisor in Sydney depends on factors like:

- The advisor’s experience,

- The range of services provided,

- The complexity of your financial situation and

- The fee structure they use.

According to Advisor Ratings, the average cost of a financial advisor is about $3,500. As with any profession, this can increase to upwards of $30,000 depending on the complexity of your situation and the value they can provide through their advice.

For example, if a financial advisor could help you save $60,000 in tax and improve your retirement savings over the next 10 years by $300,000, you’d likely be happy to pay them a fraction of that benefit, right?

It’s important to look at seeking financial advice as an investment rather than an expense. Great financial advice could mean the difference between falling short of your financial goals or achieving financial freedom.

Here’s a simple case study of the value of getting great advice:

A client came to us to ensure they were prepared for retirement and were leveraging their business profits to create more personal wealth.

They had a successful business, had their home paid off but wanted to achieve some big goals over the next 10 years.

Their goals included;

- Upgrading their home and getting it paid off within 5 years.

- Reducing their tax where possible while building wealth.

- Working towards creating $200,000 a year in passive income.

- Ensuring they had a diversified portfolio that wasn’t taking excessive risks.

After some digging, we realised they had not structured their wealth correctly. They were:

- Paying excessive fees through their superannuation,

- Had unused contributions to super that could be utilised to drastically reduce an upcoming capital gains tax bill and

- Could use equity in their home to build tax-effective wealth.

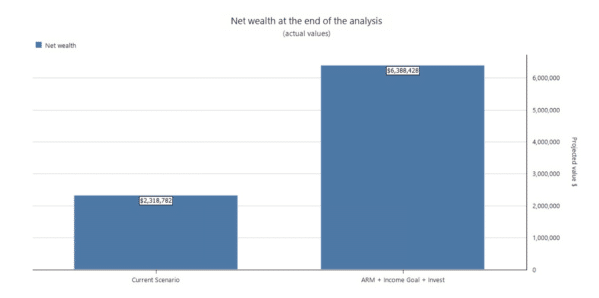

As a result of our advice, the client will take their wealth from a forecasted $2,318,782 to $6,388,428 over the next 20 years while achieving all of their lifestyle goals.

For this advice, we charged them $18,000 (0.45% of the value created).

As you can see, the impact of advice can be huge depending on your situation.

How do Financial Advisors Get Paid?

Financial advisors typically charge fees in one of these several ways:

- Assets Under Management Fees: These advisors charge a fee based on a percentage of the assets they manage for you. The percentage fee typically ranges from 0.5% to 2% of assets under management (AUM) per year. If your portfolio is worth $300K and they charge 1%, it’ll cost you $3K per year. Some financial advisors also charge based on the returns they help you get on your portfolio. Different advisors have different fee structures for this.

- Fee For Service: Some advisors charge you a flat fee for their services. Their flat fee depends on many factors like the type of advice they give you, the range of services they provide and their level of expertise. This can range from $3,000-$30,000 depending on the services you want, frequency of service and complexity of the advice

- Value-Based Advice: A methodology founded by Aureus Financial is a new way of providing financial advice in Australia. After seeing many Financial Advisors charge fees without having a clear Return On Investment for their clients, they designed a new model that is focused on client outcomes. As such, Value Based Advice aims to ensure that each client gets a 2-4x value from working with them (or they will work for free until they get that result)

You can check out our client case studies and wins at www.aureusfinancial.com.au/wins

- Commission-Based: Please note that financial advisors are banned from charging a commission on investment and superannuation products. Back in the day, most financial advisors pushed the products that gave them the biggest commission and not the ones that benefitted their clients the most. So, the government banned them from doing so.

Financial advisors can still earn commissions on certain insurance products, such as life insurance, income protection insurance, and health insurance. Regulations have been put in place to ensure that advisors prioritize their client’s best interests when recommending insurance products (more about this in a minute).

- Hourly Rate: Some advisors charge an hourly rate for the time they spend working on your financial situation. Hourly rates can vary widely, depending on the advisor’s experience and expertise. This is a very uncommon method but if they’re just educating you, they can charge an hourly rate. If you want their ongoing services, you’ll have to pay them a yearly retainer fee (or a certain percentage of your portfolio).

- Project-Based Fee: If you need assistance with a specific financial project, like creating a retirement plan or managing debt, advisors might charge a one-time fee for that project.

Here’s a list of average fees a financial advisor charges for different projects:

-

- Retirement Planning: $1,000 – $3,000+

- Debt Management: $500 – $1,500

- Estate Planning: Starting at $1,000

- Tax Planning: $500 – $2,000+

- Investment Portfolio Review: $500 – $1,500

- Education Funding: $500 – $1,500

- Cash Flow Management: $500 – $1,500

- Financial Health Check: $500 – $1,500

- Specific Financial Goals: $500 – $2,000+

Please note that this is the average range of fees that a typical financial advisor charges. It can vary depending on their expertise and the complexity of your situation. Additionally, regulations and market conditions can influence the pricing landscape for financial advisors.

How do You Find Good Financial Advisors?

Finding a good financial advisor involves careful research and consideration. Here’s a simple checklist to help you find a reputable and suitable financial advisor:

- Determine Your Needs: Clarify your financial goals, whether it’s retirement planning, investment management, estate planning, etc.

- Research Credentials: Look for advisors with recognized credentials, such as Certified Financial Planner (CFP) or Chartered Financial Analyst (CFA). Ensure the advisor is properly licensed and registered with ASIC. Ideally, choose an advisor who has a fiduciary duty, meaning they are legally obligated to act in your best interests.

- Understand Compensation: Ask about the advisor’s fee structure (hourly, flat fee, AUM, etc.). Understand how they are compensated to avoid conflicts of interest. If they’re pushing a certain product without much explanation, that might be a red flag.

- Check Experience: Inquire about the advisor’s experience and track record. How long have they been in the industry? How have they helped their previous clients? Do they have testimonials? Check if they have any industry associations. Advisors affiliated with professional associations may adhere to higher ethical standards. This also includes checking online reviews, past client case studies and testimonials.

- Interview Multiple Advisors: Consult with multiple advisors. Compare their services, fees, and communication styles. If you’re confused, just ask a friend or a relative to recommend you a good financial advisor.

- Transparency and Communication: Choose an advisor who is transparent about their process, communicates effectively, and listens to your needs.

We’ve given a list of questions to ask a financial advisor at the end of this article. Make sure you ask the relevant ones while interviewing them.

What are The Laws That Protect You From Fraud in Financial Advice?

The government demands financial advisors to act in your best interest. They can’t recommend products that are bad for you but make them big commissions. There are a few laws that keep financial advisors in place:

- Corporations Act 2001: This is the rulebook for businesses, including financial advisors. It lays out how they should act, especially when it comes to giving financial advice. It sets the expectation that advisors must act honestly and prioritize their clients’ interests.

- Future of Financial Advice (FOFA) Reforms: In 2012, there were important changes made to how financial advice works. These changes make sure that advisors always have your best interests at heart. They can’t suggest things just to make more money for themselves. The reforms also put a stop to advisors getting paid in ways that could create conflicts of interest.

- Australian Securities and Investments Commission (ASIC) Act 2001: This act created a watchdog called ASIC. Think of ASIC as the protector of fair practices in the financial world. It monitors advisors and makes sure they follow the rules. If an advisor isn’t doing things the right way, ASIC can step in and sort things out.

- Financial Adviser Standards and Ethics Authority (FASEA) Standards: This is about setting high standards for financial advisors. It ensures that they are well-educated and follow a code of ethics. Advisors must act responsibly, provide accurate advice, and act in ways that benefit their clients.

- Privacy Act 1988: This law is about protecting your personal information. Advisors must keep your private details confidential and ask for permission before sharing them.

If You Already Have a Financial Advisor, What Questions Should You Ask Him to Make Sure You’re Getting the Full Worth of Your Money?

Let’s say you implement all the advice and get a good financial advisor. Now, there are certain questions that you should ask periodically to make sure you’re getting the full worth of your money.

You can also ask these questions to a financial advisor you’re thinking about hiring.

- Can we revisit my financial goals to make sure they are still aligned with my current situation and aspirations?

- How is my portfolio performing compared to the market and my goals?

- Have there been any significant changes to my investment strategy or asset allocation?

- Can you provide a breakdown of all fees and expenses associated with managing my investments?

- How is my portfolio structured to manage risk? Are there any adjustments needed based on recent market developments?

- Are there any opportunities for tax optimization in my portfolio or financial plan?

- How often can I expect updates and communication about my investments and financial plans?

- Can you provide insights into current market trends and how they might impact my investments?

- How do you decide when to make adjustments to my investment strategy?

- Could you connect me with other clients who’ve been working with you for a while? I’d like to hear about their experiences.

Whether you’re looking to get financial advice or review your current advice relationship, our team is here to help!

P.S. When you’re ready, here are three ways I can help you increase your business profits and wealth:

- Get my best-selling books, financial calculators and a tonne of worksheets for FREE!

In our FREE Facebook Community, we have an on-ramp program that will help you map out your goals, review your foundations, get some quick runs on the board and get you excited again about your life and business. - Complete our Financial Performance Scorecard and see how you’re tracking to financial freedom

There are 40 things that get in the way of you and financial freedom as a business owner. The scary thing is that the average score is 19/40. See if you have an A+ Business (35+/40) or a below-average business (20/40) and learn how you can make it A+. - Book a Breakthrough Session

And if you ever want to get some 1:1 help, we can jump on the phone, and brainstorm how to remove cashflow bottlenecks and turn your business profits into personal wealth.

Grab all of that at www.wealthhealthcheck.com.au