After being involved in the finance industry for close to 10 years, I have seen my fair share of spruikers come out of the wood works.

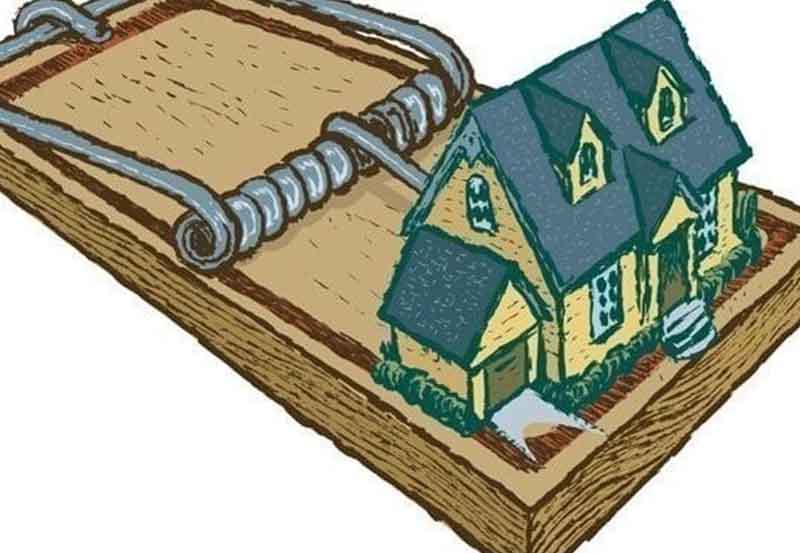

These opportunistic ‘professionals’ seem to appear soon after a strong performing property market where the hype around missing the boat is high, plenty of investors have already experienced lots of growth and the market is close to fully valued. From a behavioural finance perspective, this is the point of time where lots of less experienced investors feel pressure to get a foot on the ladder and can be easily persuaded into less than favourable deals. This guide is aimed to give you some valuable insight into what to look for when reviewing an asset, who to look for when getting advice and how to verify the accuracy of the information provided to you.

As a financial adviser, my objective for all of my clients is to take the least amount of risk to achieve the desired outcome and what I have found is that risk directly correlates with expected returns. When looking to acquire any asset it is best to start with the macro (big picture) first and work your way down. The key metrics when considering property as an asset class are as follows:

- Diverse range of local employment: Buying in an area that doesn’t rely on a single sector of employment is important to ensure that your tenants can always pay rent and afford to spend more on property

- Positive migration figures: The area should have an increasing demand for people who want to live there meaning that the demand for property becomes higher

- Existing and proposed infrastructure: This makes an area more desirable, comfortable and accessible and it is important that there is already good infrastructure in place as it can take a long time for new projects to complete

- Supply vs demand: In line with the above points it is important to consider the current and future supply of an area and whether this is likely to fulfill the demand or leave the area over-supplied resulting in either stagnant growth or a reduction in prices

- Affordability: Can the local demographic actually afford to spend more on property from both a rental or purchasing perspective which will determine the capacity for future growth

Now I don’t profess to be a property expert but these fundamentals are the key to growth of many investments and it is important to understand the numbers before making a decision. As we know, property as an asset class is expensive to get into, expensive to get out of and there is inherent timing risk around the entry and exit given you cannot buy bits and pieces of an established property over time to reduce risks.

So how to we minimize risks when it comes to selecting either a property yourself?

- Understand and aim to put some facts around the above macro topics when looking at an area- there are plenty of sources of information including bank publications, RBA, BIS Shrapnel, market commentators, local councils etc

- Use online tools such as Domain or realestate.com.au that have now integrated property research tools and historical data. Check the long term performance from a growth and income perspective. Note that most assets operate in cycles which means that if an asset has substantially performed and is no longer affordable, it may not change in value for some time or fall in value depending on the market conditions

- Speak to local agents about the most common dwellings for the area- does it make sense to buy a unit or a house based on the types of people living in the area and even get a rental appraisal for these types of properties to work out your out of pocket costs

- Don’t buy something just for the tax incentives- negative gearing has been preached for a long time in Australia and it is important to understand that this strategy means it is still costing you money out of pocket. Tax is a secondary consideration after ensuring you are buying a quality asset

- You don’t always need to buy in your own backyard- although you may have a home town advantage in regards to the local market, it is important to go through the same research process when selecting a property. If you do choose to buy interstate it is important to ensure that you get the facts right and take your time to understand the market and the reasons why you should invest.

- Over-supply or ‘investor havens’ are common traps for new investors who look for bargains in speculative markets. Note that inner city areas are normally dominated by investors who have been sold property under the pretense of future growth potential. From historical research it has been found that many inner city suburbs under perform on the basis that due to the vast competition for both tenants or prospective buyers, this results in a lagging effect in growth and many under perform their suburban counterparts.

- Be wary of properties offering long term incentives like rental guarantees, cashback on settlement etc. If it is a solid investment then why would these things be necessary? If you work with a property buyer, these incentives can sometimes be negotiated but it is always worthwhile questioning this just in case.

If you do choose to use a property analyst or buyers agent it is important to know what to expect and how to verify their expertise:

- How long have they been in business and can they provide verified previous performance throughout multiple cycles? Like many investments, you can get lucky once but long term performance requires expertise

- How do they get paid, is it flat fee, commission finders fee, payment from the vendor etc? Much like sales agents, they can operate in many ways so it is important to understand this upfront

- What value do they add for the fee they receive? Do they just provide research, can they locate and negotiate on deals for you, do they have access to off market transactions or can they get certain incentives that you otherwise wouldn’t be able to achieve?

- If you do choose to employ a professional ensure you understand who they are working for. Are they employed by the developer to just sell their stock or are they an independent research company with no affiliation to any other provider? It is important to understand where conflicts of interest may present themselves before making a final decision

- When a recommendation is made, can they verify the sources of their research or data and provide multiple sources of credible information that was used to back their recommendation?

As you can see, property like any investment has a lot of moving parts but we find that people tend to be more easily lead astray through property given the tangible nature of the investment and the emotional sentiment of owning bricks and mortar. As such, we put a lot of emphasis on ensuring all of our clients make the most informed and educated financial decisions when it comes to selecting the right asset as part of their overall plan. Common sense is generally the best means of caution and if it sounds too good to be true, it generally is. Understand that property has historically performed in line with long term equity performance at around 9% annual return so anything promised above this is a cause for concern.

We have developed a three strategic partnerships with different property buying groups that we have verified have the right experience to provide quality outcomes to our clients so if you are interested in property investment and would like to ensure you get the right advice from an unbiased source, please feel free to contact us.

Best of luck and happy hunting!

Jackson | The Wealth Mentor