Given the time of year, we all tend to put in a lot of effort to ensure we can show our family and friends how much we care for them through meaningful gifts, cards and celebrations. In contrast, given the grim subject of death, most don’t want to come to terms with the potential risks associated with not having a proper estate plan to ensure their loved ones receive what they are entitled to.

For us as advisers, there is never an easy time to talk about these things with our clients but with a sharp increase in car accidents throughout the Christmas and New Year period, it is important for us to ensure you cover your bases.

What is estate planning?

The process of estate planning is taking the time to carefully consider what you want to see happen to your assets and how you want them dealt with in the event of your passing. Most generally understand this as having a valid will in place which will list all of your wishes to be dealt with in your absence. Unfortunately, this is not always the case and there are some considerable complexities that can arise as a result of not having the appropriate measures in place.

Why is it important?

Having a proper estate plan ensures that you are able to carefully document your wishes, provide guidance to your estate around how you wish for your assets to be distributed along with documenting any other specific bequests you may have. In the event that you pass away without a valid will, this is referred to as ‘intestate’ which means that the courts will be responsible for determining how your assets will be distributed. The potential implications of this may include;

- Your assets being distributed to individuals who you may have wished to exclude from your estate

- Excessive costs to your beneficiaries if they wish to contest the decisions made by the court

- Additional tax implications for your beneficiaries which may have otherwise been avoided

Key things to consider:

- Have a professionally drafted will with backups for your executor, trustee and beneficiaries

It is extremely important that you appoint a primary and 2 backup preferences for the roles of your estate to ensure if one is not in a position to take on the responsibility that the decision does not fall to the courts.

- Implement an Enduring Power of Attorney for medical and financial decisions

Passing away is not always the only outcome of a sickness or accident and as such, it is worthwhile considering who you wish to be able to make these important decisions on your behalf if you were to lose capacity

- Establish guardianship provisions for your dependent children

If you and your partner were to pass away, it is important who you would like the courts to consider as guardians for your children until they are old enough to care for themselves

- Establish a Testamentary Discretional Trust

This can be one of the most important parts of your estate and can provide your beneficiaries with significant tax and asset protection benefits. We will explain how this works.

What is a Testamentary Discretional Trust (TDT)?

A Testamentary Discretionary Trust (TDT) is a trust established in someone’s will. It comes into existence only when the person dies. A Lineal Descendant TDT is a trust established in someone’s will for the benefit of their lineal descendants.

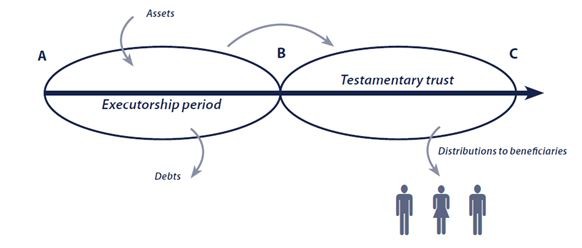

Let’s assume that someone dies at point A.

The executor’s job involves finding all the assets, paying out any debts and usually, at point B, distributing what’s left to the beneficiaries.

If there is a TDT, part or all of what’s left remains in the estate and is distributed later – at any time between point B and point C, depending on the terms of the will. Point C can generally be up to 80 years from point A.

A will can establish more than one TDT.

Who controls the assets?

Whoever is named in the will as trustee controls the TDT’s assets. Like any trust, a TDT can be as flexible or as fixed as desired. The trustee can be given full discretion or no discretion as to who should receive income and capital from the TDT and when they should receive it.

The trustee is often the same person who was appointed as executor, and can also be a beneficiary. For example, a parent can establish a TDT for each child’s inheritance. Each adult child can be the trustee of their own trust, and may also be an executor.

Minor dependents tax- how can you minimize the cost to your estate?

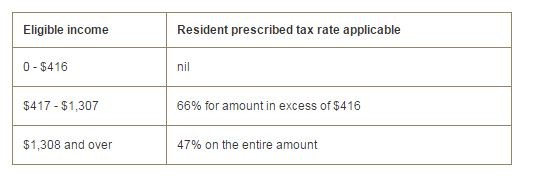

A fact that most people overlook is that minor children may not be able to manage the estate assets themselves but the beneficial ownership of those assets is still in their names in the event of you leaving an inheritance to them. What this means is that there is a potential for significant tax implications for any income earned. The tax rates for minor are as follows;

So let’s assume you have an insurance policy that pays our $500,000 to your child who is 10 years old. This money is invested and earns a marginal rate of 5% which means that the interest earned is $25,000. Based on the above tax rates the total tax liability would be $11,723 or close to 47% of the total income earned.

How can a TDT help with this?

Rather than all the deceased’s assets being distributed by the executor upon death, some or all of the assets remain in trust for the benefit of a specific group of beneficiaries named in the will.

Trust income distributed to children, of any age, will be taxed at adult rates rather than the penalty rates that normally apply to minors’ unearned income from a standard (non will-created) trust.

The trustee can have full discretion as to who receives trust income and capital, or restrictions can be provided.

So based on the same above scenario, if the child received $25,000 of income from assets within the TDT, the child could receive $18,200 tax free.

So what should you do to get advice around these items?

We advocate for our clients to have their documents created using an Estate Planning Specialist and ensure they get appropriate advice. As part of our service offering to our clients we have negotiated with a top tier law firm preferential pricing for our clients along with the ability to obtain a complimentary review of your current situation along with any existing estate planning documents you may have.

If you would like to discuss this further, please contact us directly.

Thanks for reading,

Jackson | The Wealth Mentor