With the world of AI and chatbots changing by the day, I have seen lots of use cases for creative writing, business strategy, and sales copy, however, I was yet to see the practical applications of AI for providing fine tuned, human like text financial advice and education.

The purpose of this case study was to find out if it was possible to get quality financial advice using an AI chatbot. I decided to ask ChatGPT, a natural language processing (NLP) powered chatbot some specific financial questions, provide financial goals and scenarios and ask it to provide me with educational insights, and strategic modelling, and help me make more informed decision making around my finances.

In short, I wanted to see if using chat GPT for financial advice was a viable option to make informed investment decisions and provide insightful content for wealth accumulators.

The ultimate goal was to identify if Chat GPT was capable of replacing a financial adviser and giving quality financial advice to Australian business owners.

Some of the questions we cover in this article include;

-

What is financial advice?

-

How can a Chatbot AI ChatGPT give financial advice?

-

What benefits can AI have for financial education or help me navigate the finance industry?

-

How to create prompts to ask ChatGPT financial questions?

-

How does ChatGPT compare to a human financial adviser?

-

What is the difference between a human and AI financial adviser

-

Can Artificial Intelligence (AI) provide debt advice, particularly high interest debt?

-

Can AI provide investment advice or help me make informed investment decisions?

-

Can AI provide financial advice?

-

What role will AI play in financial advice?

What is financial advice?

Financial advice is the process of understanding a client’s situation, financial goals and aspirations, identifying their available resources and creating a strategic plan to maximise their potential of achieving financial freedom. This could include budgeting, investments, retirement planning and more.

But how can Chat GPT help with this?

Chat GPT (Generative Pre-trained Transformer) is an AI-driven platform developed by OpenAI that is capable of providing quality conversationally based guidance and advice on a range of topics, including financial planning and financial education.

I decided to take Chat GPT for a spin and ask it some questions related to my finances in order to see if it could provide me with valuable insights. I was really impressed with the results in some aspects and I was let down in others.

The goal was to test the limitations of the system, identify where it was strong, where it had blind spots and how a layperson could use the tool in order to improve their financial outlook.

My Hypothesis

Entering into this experiment I wanted to formulate a hypothesis to test against. My view was that Chat GPT is a process-driven language engine that uses prompts in order to predict the best response.

Financial advice is a combination of detailed fact-finding, specific goal setting, understanding financial strategies and tactics, identifying risk and reward trade-offs and applying these strategies in a way that maximises the client’s likelihood of financial success.

My belief was that Chat GPT would be fine with providing factual and educational information, however, would be unable to discern the best strategies to apply due to superficial questioning techniques.

Given that most clients have holistic goals that span short, medium and long time horizons, experience fluctuating financial results, and shifts in focus from qualitative to quantitative drivers, this is far too many variables for a generalist chatbot to handle.

I personally believe that future versions of the technology could successfully be trained to follow these processes, however, I was not convinced the technology was there yet. Additionally, these technologies are limited by the quality of the questioning and in turn, there is a pre-requisite knowledge requirement to get the most out of the tool.

Prompt Engineering

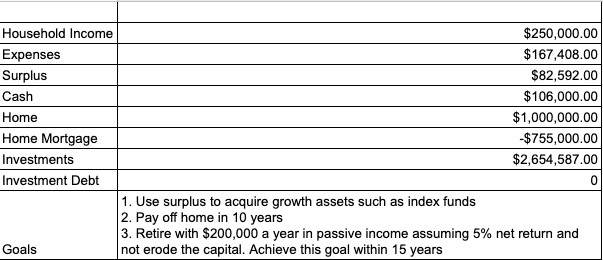

I wanted to provide Chat GPT with a solid set of financial data in order to allow it to work its magic. The financial data needed to include net household income, household expenses, cash surplus, cash on hand, home value, home mortgage, investment assets, investment, debts and some basic financial goals. We wanted to use finance industry standards to provide financial data that was enough to get some value.

The idea was to provide enough information to test the ability of the system to comprehend the financial position, however, leave enough gaps to see if it was capable of identifying missing information that would be required in the finance industry in a typical financial advice process.

The financial data provided was as follows;

The information provided was what I would expect a retail investor to know and provide to a tool like this. I purposely did not provide interest rates, assumed rates of return or other assumptions to see if it would ask me for this information.

Note – in a typical financial advice process, we would ask a client for over 300 data points which would ensure we have detailed and accurate information spanning cash flow, debts, informed investment decision making, retirement savings, tax structures, risk profile, insurance, estate planning and personal information that could impact their financial plan.

Using Chat GPT For Financial Advice Case Study

The conversation was quite extensive and took over 30 minutes. I have recorded a video walkthrough which provides a step-by-step analysis of the conversation, highlighting the pros and cons.

You can watch this video below;

Loom Walkthrough – https://www.loom.com/share/b80a504e7eea4dc3ba265372d1c9b356

Putting ChatGPT To The Financial Test

Chat GPT was quite impressive when providing educational information, basic financial calculations and generating high-level ideas and concepts. As it is a language engine, it is able to summarise rather complex topics well which could be a valuable resource for someone looking to brainstorm ideas, identify potential blind spots and crunch simple formulas.

For example, I asked Chat GPT the following;

Me – My mortgage currently has an interest rate of 5% and a monthly repayment of $3500. Based on my surplus, how much would I need to pay off my mortgage to be debt free in 10 years?

Chat GPT – To calculate how much you would need to pay off your mortgage to be debt-free in 10 years, we would need to know your remaining mortgage balance. Based on the information you provided, it appears that your current monthly mortgage payment of $3,500 is covering both principal and interest payments.

Assuming your current mortgage balance is $755,000, and you want to pay off the mortgage in 10 years, you would need to make additional principal payments of approximately $3,679 per month. This would bring your total monthly mortgage payment to $7,179($3,500 regular payment + $3,679 additional principal payment).

However, it’s important to note that this calculation is based on your current interest rate of 5%, and if interest rates were to change, your payment amount could change as well. You may want to consider refinancing your mortgage to a lower interest rate if possible, which would reduce your interest payments and accelerate your mortgage payoff.

___________________

As you can see, it is able to perform basic maths and identify risks associated with the strategy. However, this is where things started to fall apart. When I asked the following follow-up question;

Me – So based on my current surplus, if I were to increase my mortgage repayment to pay it off in 10 years, how much annual surplus would I have left?

Chat GPT – If you were to increase your mortgage repayment to pay off your mortgage in 10 years, your monthly mortgage payment would increase from $3,500 to $7,179, as I mentioned earlier. This would result in an annual mortgage payment of $86,148 ($7,179 per month x 12 months).

Assuming your expenses remain the same at $167,408 per year, and your household income remains at $250,000 per year, your surplus after paying off your mortgage would be approximately $96,444 per year ($250,000 – $167,408 – $86,148).

______________________

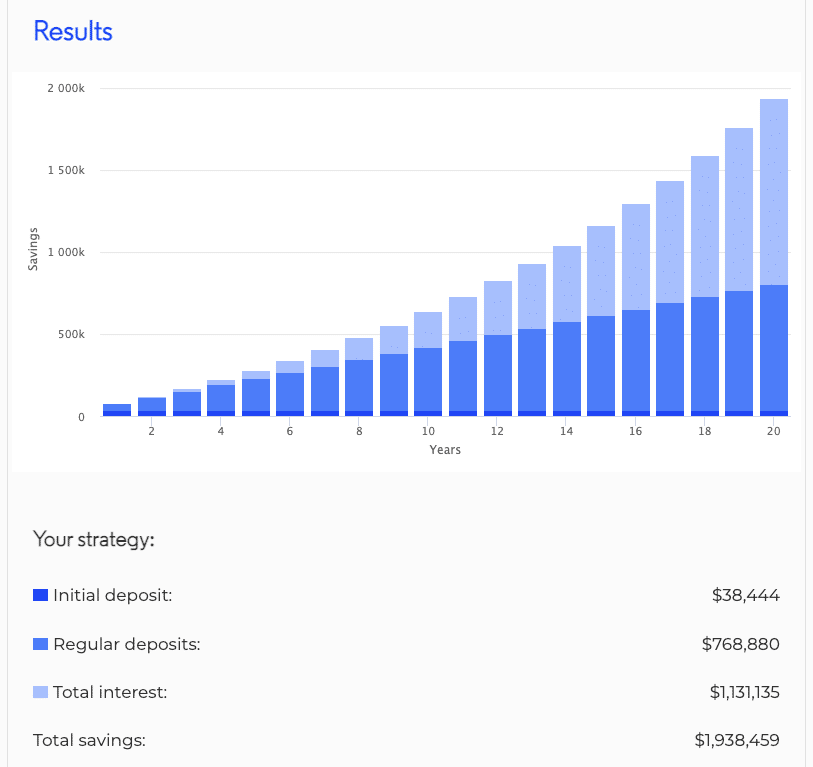

Unfortunately, the maths were wrong and the surplus calculation should have been $38,444. It misunderstood the prompt and in turn provided inaccurate data.

To provide clarification, this oversight could be worth an additional $1.9 million in wealth if allocated correctly over a 20-year time frame. This is a significant issue and illustrates the compounded risks of inappropriate advice

I tried to correct it by clarifying the financial prompts but ChatGPT struggled to comprehend the correction or which of the previously provided data was correct. I suspect I could have cleared the chat, provided a clearer calculation of expenses and segmented the current mortgage repayment, however, this troubleshooting should not be expected of a layperson with no financial training,

How ChatGPT stacked up against our expert financial advisers

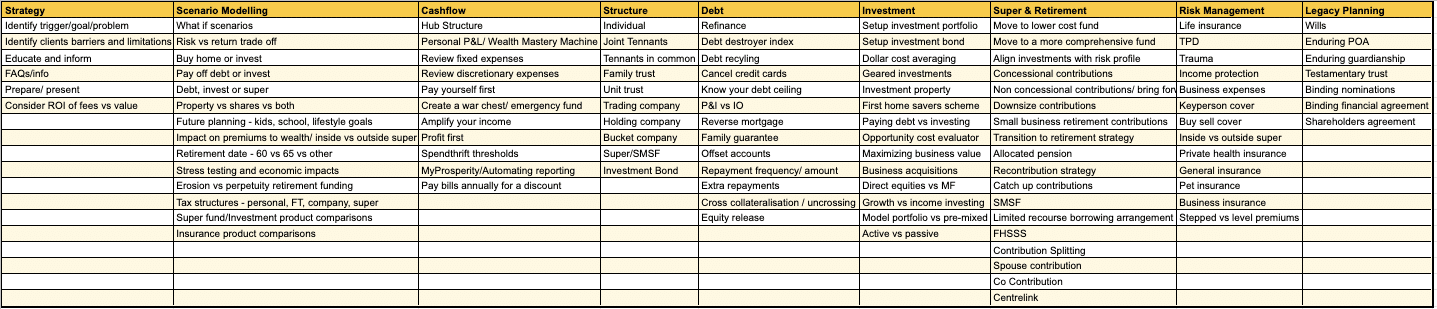

Having been involved in the wealth strategy space for over 15 years and helped thousands of clients accumulate in excess of $2 billion in wealth, we know a thing or two about good wealth strategy.

When we work with a client, we consider over 106 strategies that include Strategic Planning, Scenario Modelling, Cash Flow, Structure, Debt, Investments, Superannuation and Retirement, Risk Management and Estate Planning.

Our process typically involves over 40+ hours of research, client meetings, financial modelling, forecasting, risk vs reward trade-offs, advice creation, alternative strategy considerations and implementation.

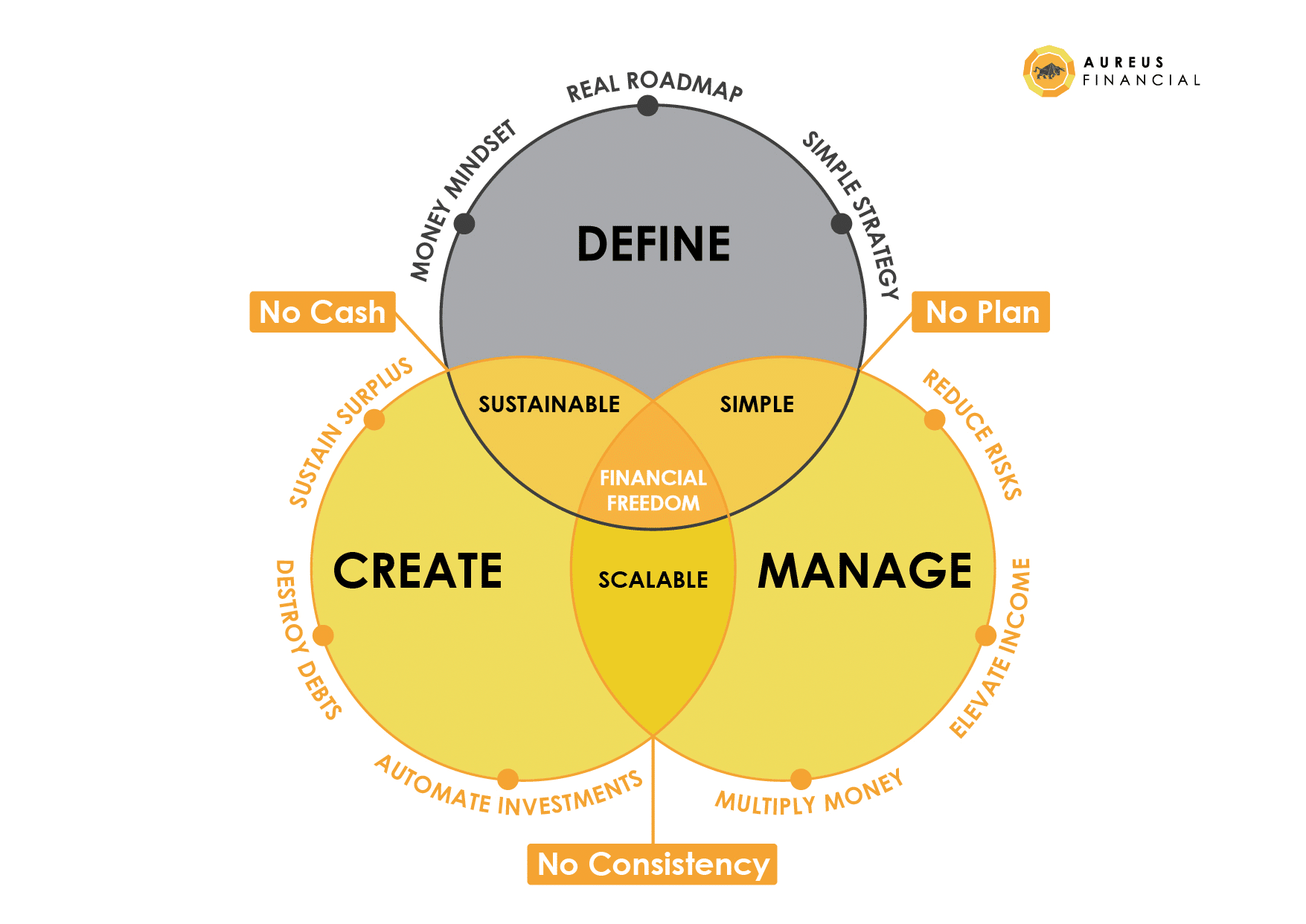

This methodology utilises our proprietary Wealth Mastery Machine framework we have used with thousands of clients to amass over $2 billion in wealth. As a specialist advisory business, we have specialised in this and for that reason, we have an edge over a generalist chatbot.

As you can see, this is a lot of considerations with thousands of data points that need to be examined, analysed and decided upon.

When speaking to my team of expert advisers/ advisors with a combined experience of over 50 years, and asking them to consider the same questions, there were a variety of differences in the conversation structure and depth of questioning.

When breaking this down into the core goals, the differences in approach were as follows;

-

Clarification of current position

a. Interest rates, assumptions around income and expense changes, risk tolerance and other goals and objectives such as lifestyle goals, renovations, and vehicles were also considered

b. Understanding of previous investment experience, preferences for investments and ethical views

c. Understanding of risk management and asset protection including personal protection and insurance, emergency funds and estate planning

-

Debt Goals

a. Discussion around why paying off the home in 10 years was important

b. Alternative strategies such as debt recycling and using deductible debt to acquire investments, ways to optimise tax and advanced debt strategies based on risk tolerance

c. Preferences for property and the benefits of leverage to acquire real estate and the potential for increasing cash on cash returns

-

Investment Goals

a. Confirm passive income goals, define real income requirements based on expected future lifestyle and discuss longevity

b. Discussing erosion based vs perpetuity based wealth planning and preferences for maintaining capital value

c. Discussing other potential impacts to future wealth such as business sale, downsize or inheritance

d. Discussing asset allocation, investment tax structures such as Family Trust, Investment Bonds and Superannuation

e. Discussing diversified vs asset-specific index funds and managed funds considering asset allocation, fees and historical performance

As you can see, the conversation facilitated showed a significantly deeper understanding of personal financial planning, common scenarios encountered, ‘what if’ trade-off conversations and how to balance quantitative and qualitative goals and objectives.

The Difference Between A Human And Artificial Intelligence AI Financial Adviser/ Financial Advisors

ChatGPT, on the other hand, failed to provide any of these sophisticated solutions and was simply used as a tool for basic calculations. While ChatGPT may have given me some semblance of financial advice, it by no means removed the need for an expert human adviser/ advisor.

The most significant issue is the inability to trust ChatGPT to provide accurate calculations. Without the appropriate knowledge, I would have been unable to identify where it made errors and the implications of this could have been substantial.

For example, choosing to allocate additional funds to a mortgage compared to investing could amount to multi 6 figures in lost opportunity.

Overall, ChatGPT provides a great tool for basic calculations and can act as an aide to help you understand the basics of personal finance. However, it is important to remember that ChatGPT cannot replace the expertise and knowledge of human financial advisers/ financial advisors when making decisions regarding your financial strategy.

What are the benefits of Chat GPT in financial advice or financial education?

Chat GPT can be a great resource for basic calculations and can act as an aide to help you understand the basics of personal finance. If you want to expand your knowledge, get the pros and cons of various high-level strategies, perform simple calculations or use it as a sounding board, it can be a valuable resource to use.

Like any Artificial Intelligence (AI) tool, its ability to provide you with valuable responses is based on the quality of your questions so without some existing knowledge, you may struggle to get deep insights from the technology.

My personal opinion is that tools like Chat GPT will work best for a professional who has a deep understanding of the subject matter, knows the financial formulas and methods for calculation and will utilise AI as an assistant which can aid in the advice process.

This will require substantial training and structure surrounding the technology to ensure it is able to understand the most up-to-date legislation, financial strategies, tax rules, compliance and products, along with the ability to understand questioning methods to ensure it can go deep enough to suggest strategies and tactics that are appropriate.

The reality is that this is a learned process that a human uses that can be replicated in AI.

As a layperson without a financial background, I personally wouldn’t trust AI to provide quality advice.

Financial Questions That Could be Answered by Robots

with the risk of getting a bias, self-preserving response, I asked Chat GPT this question and wanted to see what it would respond with. I was actually quite surprised by its reply and it fills me with some confidence that AI isn’t plotting to take all of our jobs and overthrow the world!

Chat GPT Replied;

What is the best way to create a budget and stick to it?

What are the best investment strategies for someone with a low risk tolerance?

What are some tips for paying off debt quickly?

What are the pros and cons of leasing a car versus buying a car?

How can I improve my credit score?

What is the best way to save for retirement?

What should I look for when selecting a financial adviser?

How can I

minimizeminimise my tax liabilities?What are some ways to protect my assets in the event of a lawsuit?

How can I prepare financially for major life events, such as having a child or buying a home?

These kinds of questions are information and education based and I would feel comfortable asking these questions to an AI. It can be a great way to prepare for financial advice, expand your knowledge and improve your financial knowledge.

Chat GPT is not a replacement for financial advice, but it can certainly provide helpful guidance and education.

At the end of the day, Chat GPT provides a great tool to start conversations around personal finance, get an understanding of basic calculations and use it as a sounding board. However, when making decisions regarding your finances and investment strategies, it is important to always consult a professional financial adviser/ financial advisors

AI technology could bring an exciting element to the traditional advice process and Chat GPT is certainly pushing in the right direction to provide people with useful insights into their personal finances.

Financial Questions That Should be Answered By A Financial Adviser

I asked the same question to Chat GPT to see what it would tell me. I almost hoped it would try and dilute the value a human could provide in comparison, however, it remained quite objective in its reply.

Chat GPT responded;

As an AI language model, I can provide general financial information and guidance, but for specific personal finance questions, it is best to consult a licensed financial advisor. Here are ten questions that may be best answered by a financial advisor:

What should my investment strategy be based on my risk tolerance, financial goals, and time horizon?

How can I optimise my retirement plan contributions to maximize tax benefits and returns?

How should I allocate my assets in a way that minimizes risk and maximizes returns?

What is the best way to manage and reduce my debt load?

How can I best protect my assets and wealth in the event of a financial crisis or downturn?

What is the best way to plan for estate and legacy planning?

What is the best way to prepare for and manage large expenses such as buying a home, funding a child’s education, or starting a business?

What are the best tax strategies for minimising my tax liability while minimising my returns?

How can I plan for long-term care and medical expenses as I age?

What are the best strategies for charitable giving and philanthropy to maximize impact and tax benefits?

To give it credit, it has accurately considered the complex topics that fall outside the scope of what AI can help with. Chat GPT is just a tool, and it shouldn’t be used in place of the expertise of a financial advisor.

My Conclusion of AI Financial Advice

Overall, Chat GPT provides an interesting glimpse into the potential of AI-powered tools to help people with their personal finances. It may not be able to provide advice on complex topics like estate planning or tax strategies, but it can help people get comfortable with their finances and understand the basics of personal finance.

I definitely see the role of AI supporting the financial advice and financial literacy process much like a human assistant. As a result, we all need to improve how we structure questions, use AI processing methods to effectively unpack knowledge and use AI to make better decisions in shorter timeframes.

As a result, I hope that tools like Chat GPT can help inspire more Australians to seek financial advice and make better financial decisions to create financial freedom faster.