Credit card reward programs are enticing with their promises of cash back, travel benefits, and discounts on eligible purchases. But do these rewards actually make it worth signing up?

Over the years of working with thousands of business owners and wealth accumulators, we’ve seen those who are cult-like advocates for rewards credit cards, those who are passionately against rewards credit cards worth and those who are on the fence.

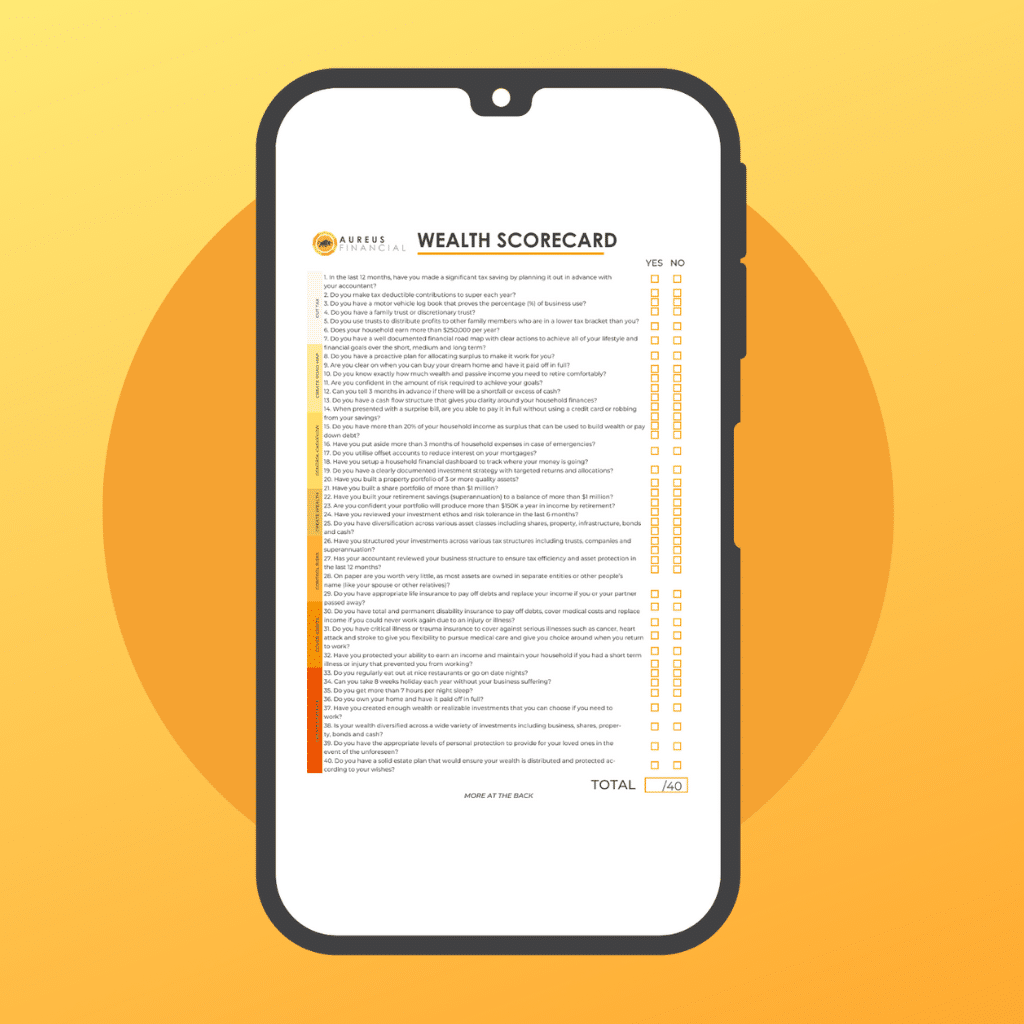

PS – if you haven’t already, complete our 40 point financial performance scorecard and see how you’re tracking towards financial freedom —> bit.ly/aureusscorecard

No matter your position, it’s important to use objective facts and financial reasoning to make informed and educated financial decisions. In Aureus Financial style, we wanted to debunk the myths and misconceptions in a never before seen case study.

It’s important to weigh both the bonus rewards and potential upsides and downsides; such as increased spending or interest charges that could negate any value from the rewards. In this blog post, we explore the real-world value of credit card points by researching case studies, analyzing data and presenting our findings in an easy-to-understand format so you can make decisions for yourself.

Note – this case study should not be taken as advice and you should consult your financial adviser or mortgage broker before making any debt decisions.

What is a rewards credit card?

A rewards credit card is a type of credit card that offers incentives or benefits to cardholders based on their spending. These incentives earn rewards can come in the form of credit card points, miles, or cashback, which can be redeemed for various rewards such as travel, merchandise, gift cards, or statement credits.

Here’s a brief overview of how rewards credit cards work:

-

Earning rewards:

With each purchase made using a rewards credit card, you’ll earn a certain number of credit card points, miles, or a percentage of cashback, depending on the card’s rewards structure. Some cards offer a flat rate for all purchases, while others may have bonus categories that provide higher rewards rates for specific types of spending (e.g., dining, groceries, travel or frequent flyer points, cash rewards or fuel). The common programs are Qantas frequent flyer points, Velocity, American Express, and Frequent Flyer.

-

Rewards program:

Each rewards credit card is associated with a specific rewards program. These programs have their own rules, redemption options, and frequent flyer points values. It’s essential to familiarize yourself with the program’s terms and conditions to understand how to maximize the value of your rewards.

-

Redemption:

Once you’ve accumulated enough rewards, you can redeem them for various options offered by the card issuer. Common redemption options include travel bookings, statement credits, gift cards, merchandise, or even transferring credit card points to partner loyalty programs (like hotel or airline programs).

-

Expiration and limitations:

Be aware that some rewards credit cards may have limitations, such as credit card points or miles expiration dates, caps on the number of rewards you can earn, or restrictions on how rewards can be redeemed. Always read the fine print to avoid losing out on any earned rewards.

-

Fees and interest:

Rewards credit cards often come with an annual fee and higher interest rates compared to non-rewards cards. It’s crucial to weigh the potential rewards against these costs to ensure that the card’s benefits outweigh the expenses.

In summary, a rewards credit card provides incentives for cardholders based on their spending, allowing them to earn points, miles, or cash rewards that can be redeemed for various rewards. To get the most value from a rewards credit card, it’s essential to choose a card with a rewards structure that aligns with your spending habits, understand how many points in the associated rewards program, and carefully consider any fees and interest rates.

Our approach to this case study

1. How Credit Card Reward Points Are Calculated:

Most credit cards offer rewards points based on a percentage of the amount spent. Many offer cash back, while others provide specific rewards such bonus points such as travel discounts or merchandise vouchers. Depending on the card and its associated reward program, rewards can range from 1-5% cash back on purchases or up to 25% extra rewards points for certain types of spending.

2. Reviewing the Numbers:

The value of credit card reward points depends heavily on how you use them. To get an accurate assessment and earn bonus rewards yourself, we’ll need to factor in all costs associated with the program such as fees and interest charges. Additionally, some cards require users to spend a certain amount per month in order to qualify for rewards.

3. Pros and Cons of Credit Card Rewards:

While credit card reward points can provide value, there are some important drawbacks to consider. Perhaps the biggest is the potential for increased spending due to the urge to ‘buy now and pay later’. Additionally, if you don’t pay off your statement credit or bill each month, the accrued interest charges and fees can quickly negate any rewards received.

Commonly Asked Questions About the Value of Rewards Points:

-

What are credit card rewards worth?

-

Do credit card reward points outweigh the costs of annual fees and interest charges?

-

Is there a risk of overspending when using credit cards compared to cash?

-

How do the reward points compare to other investment options?

-

Can rewards points be used for travel and other experiences?

Hypothesis:

Our hypothesis is that credit card rewards points might not be worth it once we consider the likelihood of overspending, annual fees, and interest charges. We have the benefit of obtaining data feeds of thousands of clients for their business and personal expenses and we have observed trends of 15-20% overspending for credit card users on average.

As such, we are confident that the cost/benefit of using a credit card is far outweighed by using cash. We as a business do not use credit cards, and neither do any of our directors personally.

Research and Empirical Evidence:

1.Feinberg, R. A. (1986). Credit cards as spending facilitating stimuli: A conditioning interpretation. Journal of Consumer Research, 13(3), 348-356.

Feinberg’s (1986) study found that participants who were exposed to credit card stimuli spent 29% more in a laboratory setting compared to those who were not exposed to the stimuli. This research suggests that the mere presence of credit cards could increase spending.

2.Hirschman, E. C. (1979). Differences in consumer purchase behaviour by credit card payment system. Journal of Consumer Research, 6(1), 58-66.

Hirschman’s (1979) research showed that consumers who used credit cards spent about 30% more on clothing and about 20% more on food in department stores compared to those who paid with cash or checks.

3.Chatterjee, P., Rose, R. L., & Sinha, J. (2013). Why money meanings matter in decisions to spend and to save money. Journal of Marketing Research, 50(1), 70-80.

Chatterjee et al. (2013) found that participants who were primed with credit card cues spent 74% more on average in a hypothetical shopping task compared to those primed with cash cues.

These studies provide additional percentage evidence that people tend to spend more when using credit cards compared to cash. However, it’s essential to consider that these results were obtained in experimental settings, and actual spending behaviour in real-world situations may vary. Nonetheless, these findings consistently support the idea that credit cards can lead to increased spending compared to cash payments.

While these figures were obtained under experimental settings, the general trend of increased spending when using credit cards compared to cash remains consistent across various research studies.

What they all share in common is the tendency to spend more when using a credit card compared to cash. This phenomenon is often linked to the “pain of paying,” which refers to the discomfort or psychological pain we experience when parting with our hard-earned money.

Interestingly, the pain of paying is generally lower with credit card transactions than with cash, which can lead to some sneaky overspending.

Let’s dive into some noteworthy research findings that shed light on this topic:

-

Prelec and Loewenstein (1998) introduced the concept of the pain of paying in their groundbreaking study. They found that we’re more likely to spend when the psychological pain associated with a transaction is reduced, like when using a credit card instead of cash.

-

Soman (2001) discovered that the delay between making a purchase and actually paying for it (a common feature of credit card transactions) decreases the pain of paying, which can result in increased spending.

-

In their study, Raghubir and Srivastava (2008) revealed that people tend to spend more when using “less transparent” payment methods, such as credit cards, compared to cash. They suggest that the form of payment can affect our perception of money’s value, ultimately influencing our spending decisions.

-

Thomas et al. (2011) showed that consumers are more likely to buy unhealthy food products when paying with a credit card than with cash. The authors argue that the reduced pain of paying with a credit card might weaken impulse control, leading to more indulgent purchases.

Factors To Consider

When objectively comparing a rewards program we need to firstly understand the factors contributing to our decision. These variables include;

-

Fees such as annual fees, processing fees and interest

-

Rewards points for spending – eg 1 point per $1

-

The cash value of points – we have found that most rewards points are worth between 1-2c per point

-

The assumed behavioural impact of using credit

-

The Return On Investment and Margin For Error – in other words, for my spending, what is the net benefit of the points and in turn, how much tolerance is available for extra spending or interest costs

-

The alternative strategies and how they compare – for example, if we are likely to spend less when using cash, what could we do with those extra savings and how does that compare to the rewards points

We have used these datapoints to create a case study for you.

Case Study Breakdown:

We conducted two case studies to assess the financial impact of using a travel rewards card compared to using cash and investing the difference in an index fund. For the purposes of the case study, we made a number of assumptions;

-

The standard monthly expenses were $10,000 per month

-

The assumed overspending due to ‘The Pain Of Paying’ with an additional spend of 15%

-

The rewards program offers 1 point per $1 spent with an assumed value of 1.25 cents per point. The card also carries an annual fee of $250

-

Scenario 1 incurs no interest as the card is cleared monthly

-

The cash spender invests the savings into an index fund making 8% per year for 10 years

Here are our calculations;

Scenario 1: Using the travel rewards card

Monthly spending:

-

Total monthly spending: $11,500 ($10,000 + $1,500)

-

Annual spending: $138,000 ($11,500 x 12)

Points earned:

-

Monthly points: 11,500 points (11,500 x 1 point per dollar)

-

Annual points: 138,000 points (11,500 x 12)

-

Annual travel rewards value: $1,725 (138,000 x 1.25 cents)

Annual net rewards value:

-

Net rewards value: $1,475 ($1,725 – $250)

Extra spending with the travel rewards card:

-

Total extra spending over 10 years: $180,000 ($1,500 x 12 x 10)

Travel rewards points value:

-

Total net rewards value over 10 years: $14,750 ($1,475 x 10)

Net impact after factoring the value of the points:

-

Net impact: -$165,250 ($180,000 – $14,750)

Scenario 2: Using cash

Monthly spending:

-

Total monthly spending: $10,000

-

Annual spending: $120,000 ($10,000 x 12)

Using cash and investing in an index fund

-

Monthly investment: $1,500

-

Annual investment: $18,000 ($1,500 x 12)

-

Annual return: 8%

Using the future value of an ordinary annuity formula to calculate the value of the investment after 10 years:

FV = P * [(1 + r)^n – 1] / r

Where:

-

FV is the future value of the investment

-

P is the periodic investment ($1,500)

-

r is the periodic interest rate (8%/12)

-

n is the number of periods (10 years * 12)

FV = $1,500 [(1 + 0.08/12)^(1012) – 1] / (0.08/12)

FV ≈ $222,745.16

Delta between the two scenarios:

-

Extra spending with the travel rewards card over 10 years: $180,000

-

Net rewards value over 10 years: $14,750

-

Future value of the index fund investment after 10 years: $222,745.16

Total savings by using cash and investing in the index fund:

-

Savings = (Extra spending – Net rewards value) + Future value of the index fund

-

Savings = ($180,000 – $14,750) + $222,745.16

-

Savings ≈ $388,995.16

By using cash and investing the extra $1,500 per month in an index fund with an 8% annual return, the individual would have a financial advantage of approximately $388,995.16 over 10 years compared to using the travel rewards credit card account and incurring an extra $1,500 in spending per month.

Case Study 1: Travel Rewards Card vs. Cash + Index Fund Investment (No Balance Carried Forward)

-

Scenario 1: Using a travel rewards card with $10,000 monthly spending, leading to 15% increased spending ($1,500 extra per month), and paying off the card monthly.

-

Scenario 2: Using cash for $10,000 monthly spending and investing the extra $1,500 per month in an index fund with an 8% annual return.

Result: The individual would have a financial advantage of approximately $388,995.16 over 10 years by using cash and investing the extra $1,500 per month in the index fund.

Case Study 2: Travel Rewards Card (with Balance Carried Forward) vs. Cash + Index Fund Investment

The next assumption is that a balance is carried forward at a rate of $3,000 per month which incurs interest.

-

Scenario 1: Using a travel rewards card with $10,000 monthly spending, leading to 15% increased spending ($1,500 extra per month), and carrying forward a balance of $3,000 per month with a 20% annual interest rate.

-

Scenario 2: Same as in Case Study 1.

Result: The individual would have a financial advantage of approximately $393,995.16 over 10 years by using cash and investing the extra $1,500 per month in the index fund.

Conclusion:

After thoroughly examining the downsides of credit card rewards points, such as overspending, annual fees and interest charges, our data indicates that individuals can save a substantial sum by sticking with cash payments and investing any extra funds in an index fund. Our research has pinpointed this to be more profitable than relying solely on reward points.

Before signing up for a credit card rewards program, it’s important to take into account the potential financial risks of high spending and interest charges that may negate any benefits provided by the points. In order to make an informed decision, everyone should carefully weigh out their options between earning points by using a rewards program versus cash or other investing opportunities.

The reality is that you have circa 1.5% threshold for overspending where the total net value of the points is eroded. If we looked at this objectively as an investment considering the financial return compared to the standard deviation of potential outcomes, most savvy investors would run for the hills.

Don’t get caught up in the romance of points and remember that banks aren’t in the business of giving money away for free!

PS – if you want access to our cash flow structure we’ve used to help our clients increase their surplus on average by 20%, join our FREE Facebook group at bit.ly/YLBGroup