Insurance and risk management is an important part of life but we have come to find that most people we speak to are under-insured and under-protected when it comes to their personal risk management plans.

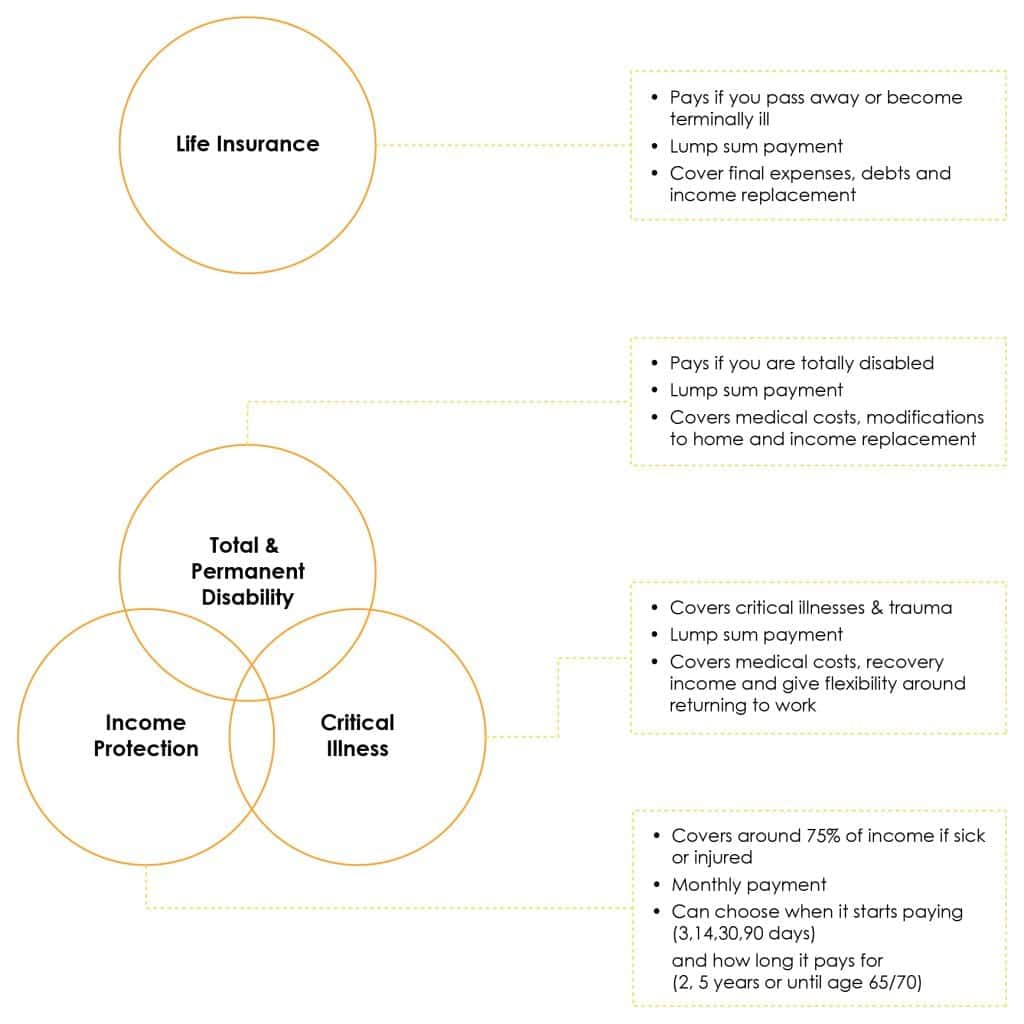

There are 4 key types of insurance for individuals:

We’re considering life insurance if you pass away basically covering any debts and replacement of income in your absence. Secondly is a total and permanent disability. So if you are totally and permanently disabled, it basically provides any debt repayments, any medical expenses and also any shortfall in income. Thirdly is a critical illness or trauma insurance. If you suffer a critical illness such as cancer, heart attack, stroke, it covers the medical costs and potentially the lifestyle costs associated with that happening. And then finally, there is income protection. So it’s basically a catch-all. If you can’t work due to any injury or illness, it will have you covered for up to 75% of your income.

Now the first things first that you need to consider is your needs and wants. What are you actually trying to protect? Is this because you’ve just got a young family? You’ve got young kids? Is it because you’ve got a lot of debt? Is it because of a business partnership that if something happened to you, your business couldn’t continue? We need to consider the situation. And then what we want to consider is what we want to see happen in that situation. We want all that it to be paid off just some of it just the debt on the home and how much income do we want to have replaced and to how long. This is rather complex and ultimately, it’s best facilitated by a risk management expert who knows how to take you through this exercise and then identify how much cover you actually require.

After that, we then need to select the structure. Are we going to have it inside super? We can have it outside super. There are pros and cons for both. And then finally, we then need to pick the insurer. Are there certain things that you are concerned about. For example, if you’ve got a family history of heart attacks or cancers, then we want to make sure that we have better definitions in those areas. We then need to work out pricing and all those types of things.

We put a lot of time and effort into this. Most people overlook it. They think they can just jump on to an iSelect or one of those comparison sites typing I need life insurance and select a million bucks and basically get it in a couple of minutes. Typically, the faster it is, if you’re getting automatic acceptance, is not a great policy. Most providers will ask you the questions at some point. You want them to ask you the questions up front. The last thing you want them to do is to ask your family all of the questions God forbid if you would have passed away. So make sure you get good advice on these things.

The good thing about insurance is that insurance similar to when you get a home loan, the insurance provider that is ultimately selected for you, pays the risk specialists a commission for the service. Meaning they had a lot of instances you don’t need to pay. So it’s worthwhile reevaluating, looking at what you’ve got because most people do have insurance inside their super. So I’ll just kick the tires on it. Have an understanding of your risks and at least then you can work out your next best steps from there.

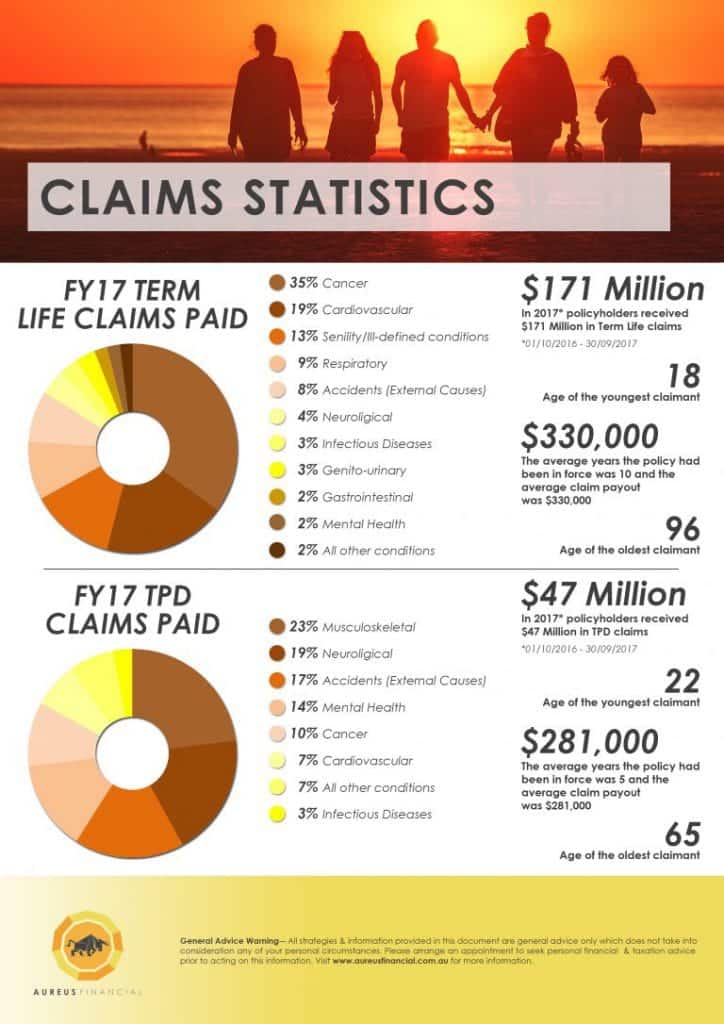

See below the claim statistics we obtained from leader insurer BT.

If you want to learn more about insurance, click on the link below!